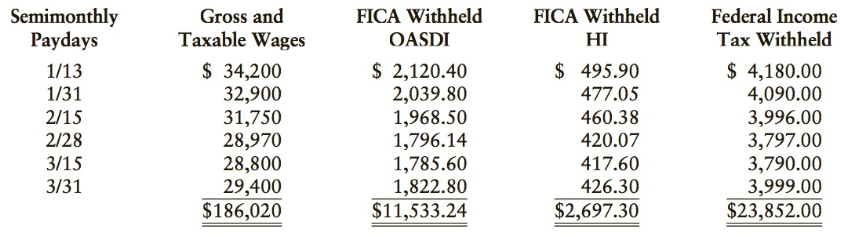

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter

Question:

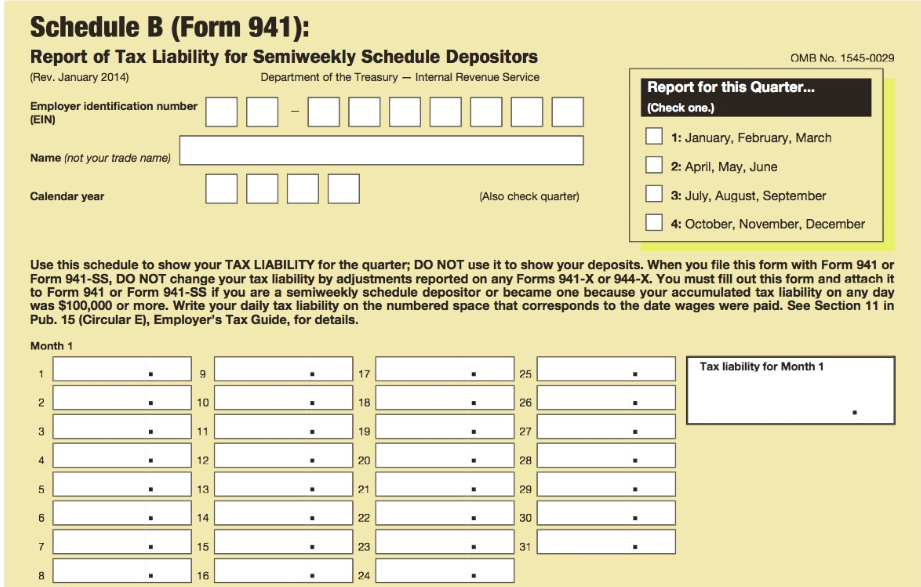

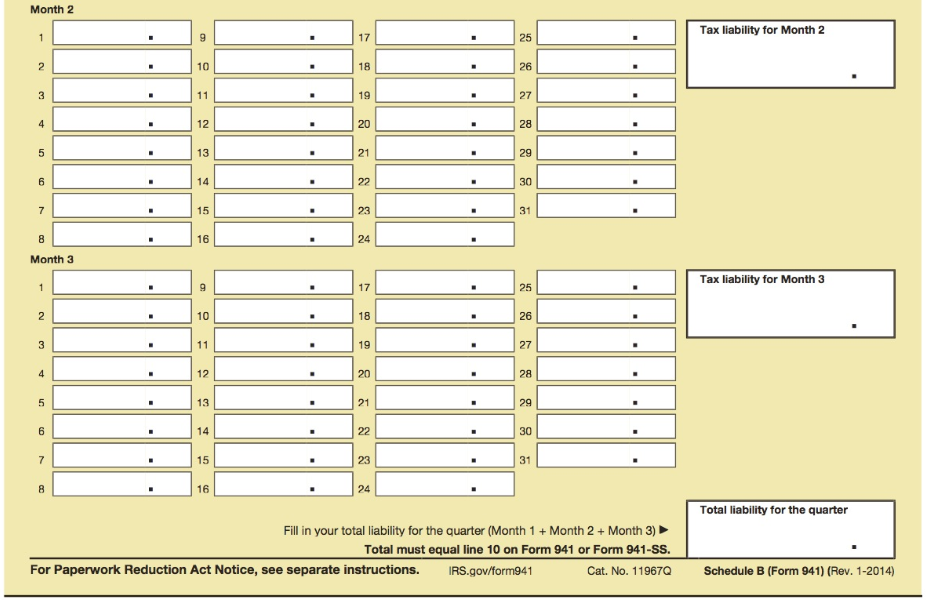

a. Complete Schedule B of Form 941 on page 3-65 for the first quarter for Harry Conway, the owner of Hamilton Company.

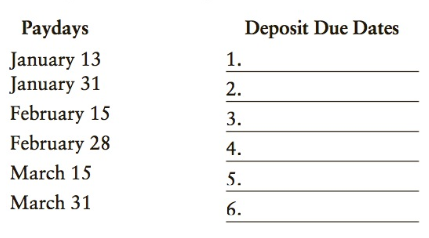

b. Below list the due dates of each deposit in the first quarter.

Transcribed Image Text:

Semimonthly Paydays 1/13 1/31 Gross and FICA Withheld OASDI FICA Withheld Federal Income Taxable Wages Tax Withheld HI $ 34,200 $ 2,120.40 2,039.80 $ 495.90 $ 4,180.00 32,900 31,750 28,970 28,800 29,400 $186,020 477.05 4,090.00 3,996.00 3,797.00 3,790.00 3,999.00 $23,852.00 2/15 1,968.50 1,796.14 1,785.60 1,822.80 $11,533.24 460.38 2/28 3/15 3/31 420.07 417.60 426.30 $2,697.30 Paydays Deposit Due Dates January 13 January 31 1. 2. February 15 February 28 3. 4. March 15 5. March 31 6.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (15 reviews)

a b Due Dates 1 January 18 2 February 3 3 February 22 4 March 3 5 March 22 6 April 5 Schedule B Form ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The taxable wages and withheld taxes for Stafford Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 2016 follow. a. Complete Schedule B of Form 941 for the first quarter for...

-

b Riverbed prepares an income statement for the first quarter of 2017 ending on March 31 2017 installation was completed on June 18 2017 How much revenue should Riverbed recognize related to its sale...

-

An employer will prepare Schedule B of Form 941 under which circumstances? a. Line 12 on the Form 941 is less than $2,500. b. The employer is a semi-monthly depositor. c. The employer is a monthly...

-

Write a formula for a function g whose graph is similar to f(x) but satisfies the given conditions. Do not simplify the formula. f(x) = 3x 3x + 2 (a) Shifted right 2000 units and upward 70 units (b)...

-

Stocks may be categorized by industry. Go to www.pearsonhighered.com/sullivanstats and download the file 2_3_19. The data represent the three-year rate of return of stocks categorized as consumer...

-

Compare and contrast the implications of deviations found when testing process controls and misstatements found when performing substantive tests. Include in your discussion the rationale behind the...

-

Why does the pseudo-F statistic have the word pseudo in its name?

-

Pat Colt is auditing the financial statements of Manning Company. The following is a summary of the uncorrected misstatements that Colt has identified during the last three years. These misstatements...

-

ournal entry worksheet Tom Canuck provided a $71 receipt for repairs to the club's computer, so I paid $71 cash to him. Record the transaction. ote: Enter debits before credits

-

Poller Corporation (a fictional company) operates a chain of discount retail stores. The follo ing is information taken from a recent Potter annual report. Note 5: Mortgages on Property, Plant, and...

-

Your assistant has just completed a rough draft of Form 941, shown on pages 3-70 and 3-71, for the quarter ending March 31, 20--. As the supervisor and authorized signer, you are auditing the form...

-

During 2017, Rachael Parkins, president of Mathieson Company, was paid a semimonthly salary of $7,000. Compute the amount of FICA taxes that should be withheld from her: OASDI HI a. 9th paycheck b....

-

ANES2008* In the 2008 survey, people were asked to indicate the amount of time they spent in a typical day receiving news about the election on the Internet (TIME1) and on television (TIME2). Compare...

-

On a dreary morning in May 1995, Paul found himself sitting on the floor of the hallway, crouched against the cold wall, feeling dejected and desperate. The bustling cacophony of the people in nearby...

-

Two speakers S1 and S2 are at a distance from each other. Point Q is located at y = 2.1 m above loudspeaker S2 while point P is located at x = 4.1 m in front of loudspeaker S1. The two loudspeakers...

-

Q1 Go to the Office of the Superintendent of Financial Institutions (OSFI) and find data (as of December 31, 2020) for all domestic banks on total liabilities, total deposits, and residual of assets...

-

Explain your viewpoint/philosophy on the Christian's responsibility to demonstrate wise stewardship of higher education resources. How should a believer handle the institution's finances? As you...

-

TranscribedText: 4. DQ 5. Create your initial post on the DQ 5 Discussion Board in response to the following: e There are many different opinions about how media, specifically TV and the Internet,...

-

Find dy / dx. X || y x + x

-

The diagram shows the two forces acting on a small object. Which of the following is the resultant force on the object? A. 8 N downwards B. 8 N upwards C. 2 N downwards D. 2 N upwards 3 N 5 N

-

During the year, Zeno Company has a SUTA tax rate of 6.3%. The taxable payroll for the year for FUTA and SUTA is $77,000. Compute: a. Net FUTA tax . . . . . . . . . . . . . . . $__________ b. Net...

-

Yengling Company's payroll for the year is $593,150. Of this amount, $211,630 is for wages paid in excess of $7,000 to each individual employee. The SUTA rate in Yengling Company's state is 2.9% on...

-

Garrison Shops had a SUTA tax rate of 2.7%. The state's taxable limit was $8,000 of each employee's earnings. For the year, Garrison Shops had FUTA taxable wages of $77,900 and SUTA taxable wages of...

-

3. The nominal interest rate compounded monthly when your $7,000 becomes $11,700 in eight years is ________

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

Advanced Small Business Certifica Drag and Drop the highlighted items into the correct boxes depending on whether they increase or decrease Alex's stock basis. Note your answers- you'll need them for...

Study smarter with the SolutionInn App