Compute the cash from operations in each of the following cases (A and B). All sales and

Question:

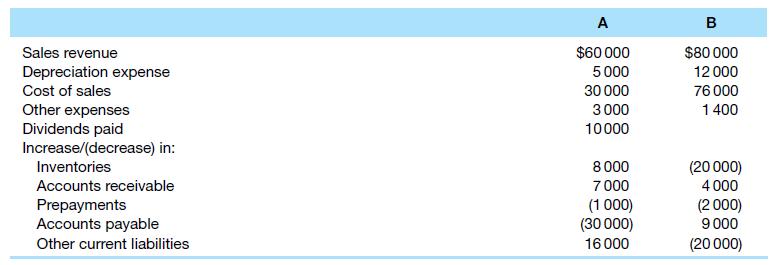

Compute the cash from operations in each of the following cases (A and B). All sales and purchases have been made on credit.

Transcribed Image Text:

Sales revenue Depreciation expense Cost of sales Other expenses Dividends paid Increase/(decrease) in: Inventories Accounts receivable Prepayments Accounts payable Other current liabilities A $60 000 5000 30 000 3000 10000 8 000 7000 (1 000) (30 000) 16 000 B $80 000 12 000 76 000 1 400 (20 000) 4 000 (2 000) 9 000 (20 000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Sales Less COS Gross margin Less Operating expenses Operating profit Add back Depreciati...View the full answer

Answered By

Beno Varghese

I have dual degrees in electronics and business with a specialization in accounting and business from ACCA. My hands-on experience in tutoring is inclined to accounting and ACCA. But I can also teach electronics and telecommunication to the students happily. I have helped so many students to complete their projects on time as well as helped them earn good marks in their respective exams. I hope this value can be delivered to the aspiring students on this platform too.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accounting Business Reporting For Decision Making

ISBN: 9780730369325

7th Edition

Authors: Jacqueline Birt, Keryn Chalmers, Suzanne Maloney, Albie Brooks, Judy Oliver, David Bond

Question Posted:

Students also viewed these Business questions

-

Compute the cash from operations in each of the following cases: Sales Revenue Depreciation Expense Cost of sales Other expenses Dividends Paid Increase (Decrease) in Inventones Accounts Receivable...

-

In each of the following cases involving travel expenses, indicate how each item is reported on the taxpayers tax return. Include any limitations that might affect its deductibility. a. Marilyn lives...

-

In each of the following cases involving taxes, explain: (i) Whether the incidence of the tax falls more heavily on consumers or producers. (ii) Why government revenue raised from the tax is not a...

-

A process is controlled with a fraction nonconforming control chart with three-sigma limits, n = 100, UCL = 0.161, center line = 0.080, and LCL = 0. (a) Find the equivalent control chart for the...

-

In Exercise 5, the following scenario was presented: As a promotion, a cereal brand is offering a prize in each box and there are four possible prizes. You would like to collect all four prizes, but...

-

The semiconductor NiO, which consists of Ni 2+ and O 2 ions, can be reacted with lithium to prepare lithium-doped Ni 1 x Li x O. Suppose x = 0.050. (a) How many lithium atoms would be present in one...

-

To understand the main elements of a Web-based business. LO.1

-

Harrelson Inc. currently has $750,000 in accounts receivable, and its days sales outstanding (DSO) is 55 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their...

-

Zvinakis Mining Company paid $180,000 for the rights to mine lead in southeast Missouri. The cost to drill and erect a mine shaft was $2,380,000, and equipment to process the lead ore before shipment...

-

A light bulb manufacturer wants to estimate the total number of defective bulbs contained in all of the boxes shipped by the company during the past week. Production personnel at this company have...

-

Smith and Jones Partnership provides specialist financial planning services to its clients. The following information relates to the year just ended. Operating expenses include depreciation of $7000....

-

Consider the following transactions. Credit purchases, $12 000. Cash paid to suppliers, $16 000. Credit sales, $21 000. Cost of sales, $15 000. Cash payments received on accounts receivable, $14...

-

Answer the below questions for a treasury auction. (a) For a Treasury auction what is meant by a noncompetitive bidder? (b)For a Treasury auction what is meant by the high yield?

-

Dr. Burgess oversees the pharmacy center within Hughes Regional Hospital. Dr. Burgess is planning on purchasing two medication dispensing units which she wants to pay back in a short-term period. The...

-

On January 1, 2021, Wetick Optometrists leased diagnostic equipment from Southern Corp., which had purchased the equipment at a cost of $1,831,401. The lease agreement specifies six annual payments...

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Employee Whatis late and Address Payroll information A -...

-

Image caption

-

Jamie Lee and Ross, now 57 and still very active, have plenty of time on their hands now that the triplets are away at college. They both realized that time has just flown by, over twenty-four years...

-

Figure P12.40 shows an experiment in which sound waves generated by a singer and having a single frequency are emitted by two speakers. These sound waves interfere at a listener located at point P....

-

a. What is the cost of borrowing if Amarjit borrows $28 500 and repays it over a four-year period? b. How many shares of each stock would he get if he used the $28 500 and invested equally in all...

-

What is meant by the 'concept of duality'? Provide an illustration involving a business transaction where the owner withdraws a printer from the business.

-

Both the journal and the ledger can be used to record a large number of transactions. Differentiate between financial recordkeeping in the journal and the ledger.

-

Discuss the purpose of a double-entry bookkeeping system.

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App