Question:

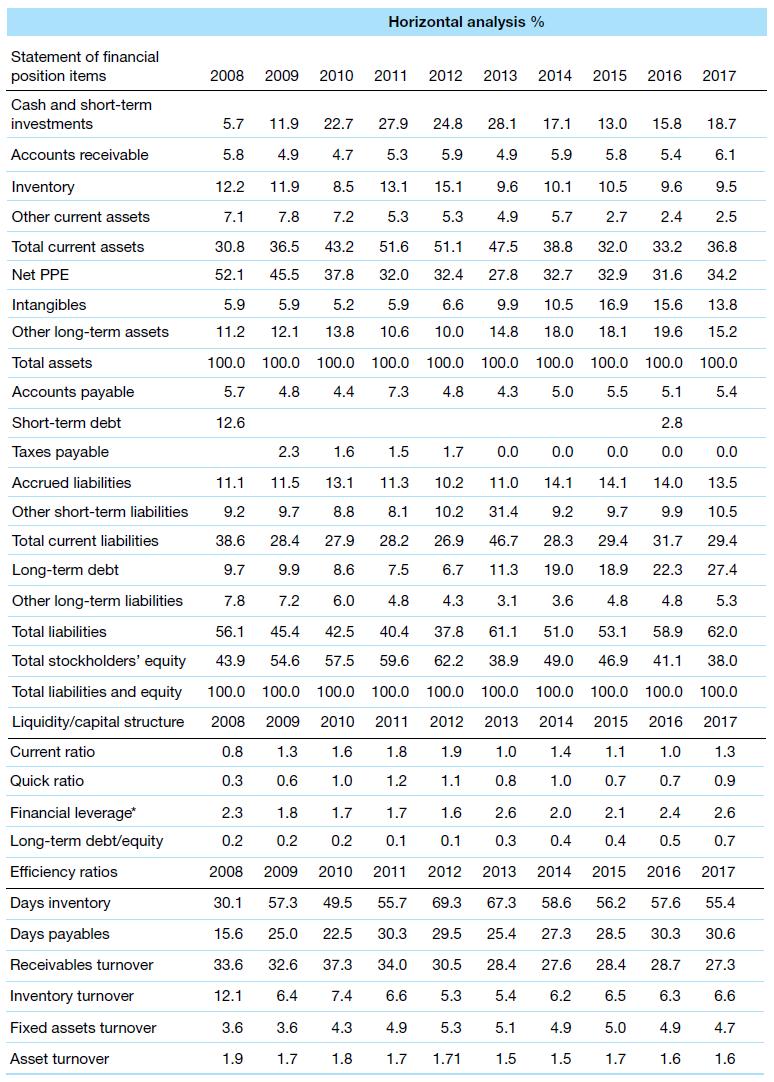

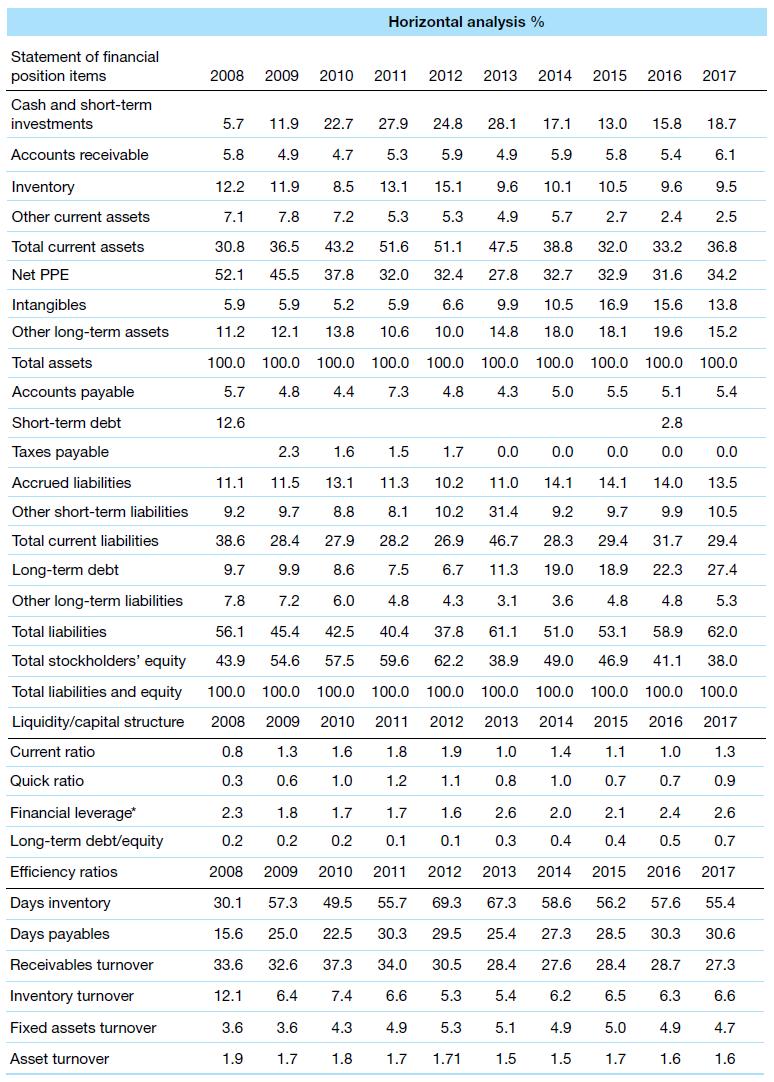

The following financial ratios and information relate to Starbucks Corporation for the period 2008 to 2017.

Required

(a) Represent the 2017 horizontal analysis of the asset section of the statement of financial position in a pie chart and comment on Starbucks’ asset composition.

(b) Represent the 2017 horizontal analysis of the liability and equity sections of the statement of financial position in a pie chart and comment on Starbucks’ financing of its assets.

(c) Prepare a trend line chart of Starbucks’ liquidity and capital structure ratios. Discuss what this trend reveals and how it assists decision making.

(d) Prepare a trend line chart of Starbucks’ efficiency ratios. Discuss what this trend reveals and how it assists decision making.

Transcribed Image Text:

Statement of financial

position items

Cash and short-term

investments

Accounts receivable

Inventory

Other current assets

Total current assets

Net PPE

Intangibles

Other long-term assets

Total assets

Accounts payable

Short-term debt

Taxes payable

Accrued liabilities

Other short-term liabilities

Total current liabilities.

Long-term debt

Other long-term liabilities

Total liabilities

Total stockholders' equity

Total liabilities and equity

Liquidity/capital structure

Current ratio

Quick ratio

Financial leverage*

Long-term debt/equity

Efficiency ratios

Days inventory

Days payables

Receivables turnover

Inventory turnover

Fixed assets turnover

Asset turnover

2008 2009

12.2 11.9

2.3

0.2

5.7 11.9 22.7 27.9 24.8 28.1

17.1 13.0

15.8 18.7

5.8

4.9 4.7 5.3

5.9 4.9

5.9

5.8

5.4

6.1

8.5 13.1

15.1 9.6 10.1

10.5 9.6

9.5

7.8

7.2

5.3

5.3

4.9

5.7

2.7

2.4

2.5

7.1

30.8 36.5 43.2 51.6 51.1 47.5 38.8

32.0

33.2 36.8

52.1

45.5 37.8 32.0 32.4

27.8

32.7 32.9 31.6 34.2

5.9

5.2 5.9

6.6

9.9

16.9

15.6

13.8

5.9

11.2 12.1 13.8 10.6 10.0

14.8

18.1 19.6 15.2

100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

5.7

4.8 4.4

7.3 4.8 4.3

5.0

5.5 5.1 5.4

12.6

2.8

1.6

1.7

0.0

0.0

0.0

0.0

11.1

11.5 13.1

10.2

11.0

14.1

14.1 14.0 13.5

9.2

9.7

8.8

8.1 10.2

31.4

9.2

9.7 9.9

10.5

38.6 28.4

27.9 28.2 26.9

46.7 28.3

29.4

31.7

29.4

9.7

9.9

8.6

7.5

6.7

11.3 19.0 18.9 22.3

27.4

7.8

4.8

4.3 3.1

4.8

3.6

51.0 53.1 58.9

56.1 45.4 42.5 40.4

37.8

62.0

61.1

62.2 38.9

49.0

46.9 41.1 38.0

43.9 54.6 57.5

59.6

100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

2008 2009

2010 2011

2012 2013

2014 2015 2016 2017

0.8

1.3

1.6

1.9

1.0 1.3

0.3

0.6

1.0

1.1

0.7

0.9

2.1

2.4 2.6

0.4

0.5

0.7

2015 2016 2017

58.6 56.2 57.6 55.4

27.3 28.5 30.3 30.6

27.6 28.4 28.7 27.3

6.5

6.6

5.0

4.9

4.7

1.7 1.6

1.6

2008

30.1

15.6

33.6

12.1

3.6

1.9

2.3

7.2

1.8

0.2

Horizontal analysis %

2010 2011 2012 2013 2014

1.7

6.0

1.5

11.3

1.8

1.2

1.7

1.7

0.2 0.1 0.1 0.3

2009

2010 2011 2012

57.3 49.5

55.7

69.3

25.0 22.5 30.3

29.5

32.6 37.3

30.5

6.4

7.4

6.6 5.3

3.6 4.3

4.9

1.8

1.7 1.71

34.0

1.0 1.4

0.8

1.0

10.5

18.0

1.6 2.6 2.0

0.4

2013 2014

67.3

25.4

28.4

5.4 6.2

5.3 5.1

1.5

4.9

2015 2016 2017

1.5

4.8

1.1

0.7

6.3

0.0

5.3