(a) Explain the relationship between Net Present Value (NPV) and Yield (Internal Rate of Return). (4 marks)...

Question:

(a) Explain the relationship between Net Present Value (NPV) and Yield

(Internal Rate of Return). (4 marks)

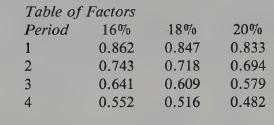

(b) A firm is considering an investment project costing £12 500. The estimated annual cash flows accruing at the end of each year are:

![]()

If the company has to borrow money to finance the project, is the maximum rate of interest it should pay for finance: 16%, 18%, 20%?

Give reasons for your answer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir

Question Posted: