Fittapool commenced business on 1 May 19_2 with 5 000 cash, installing standard sized swimming pools which

Question:

Fittapool commenced business on 1 May 19_2 with £5 000 cash, installing standard sized swimming pools which they purchased from Poolmake Ltd.

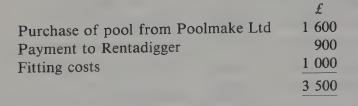

In addition to purchasing the ready made pools, Fittapool subcontract the digging of the ground in preparation for the pool to Rentadigger. The direct costs for each pool are as follows:

Poolmake Ltd are paid in full and in advance for each pool which is ordered. Payment is made immediately a customer’s order is received and the pool is delivered on site within two days. Rentadigger are paid immediately after the completion of the digging which is two weeks after the order has been placed by the customer. The fitting of the pool then takes a further two weeks and the costs involved in fitting are paid on completion of the installation.

The direct costs have remained unaltered throughout the two years but general overheads have risen from £14 000 in the first year ended 30 April 19.3 to £19 000 in the second year ended 30 April 19_4. There are no accruals or prepayments relating to general overheads at the end of either financial year. Customers pay a standard price of £5 000 per pool payable as shown on the following page.

During the year ended 30 April 19_3 sixteen orders were received and at 30 April 19_3 work on three pools was in progress; two being 40% complete and one being 60% complete. During the year ended 30 April 19_4 twenty orders were received and at 30 April 19_4 work on six pools was in progress; four being 40% complete and two being 60% complete.

At the end of each of the two years Fittapool had paid Poolmake Ltd for all of the pools on which work had commenced and, in addition, had paid Rentadigger for work done on those pools which were 60% complete.

Fittapool have adopted the following policies in their accounts.

(1) Contracts are included as revenue on the completion of the contract.

(2) Work in progress is valued as a percentage of direct costs.

Required:

(a) Fittapool’s revenue accounts for each of the years ended 30 April 19_3 and 30 April 19_4.

(b) Fittapool’s balance sheet as at 30 April 19_3 and 30 April 19_4.

(c) State and explain two accounting conventions that are involved in arriving at a work in progress valuation.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir