Kirkpatrick Limited, sellers and repairers of motor vehicles, commenced business on 1 January 19_2. The companys balance

Question:

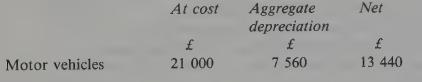

Kirkpatrick Limited, sellers and repairers of motor vehicles, commenced business on 1 January 19_2. The company’s balance sheet as at 31 December 1983 included the following items in the fixed assets section:

All the moter vehicles included were acquired when the company commenced business, the vehicles were XYZ123 costing £10 000, ABC 456 costing £7 000 and PQR789 costing £4 000. The company’s policy up to 31 December 19_3 has been to provide depreciation at the rate of 20% per annum using the reducing balance method. However, it has now been decided to adopt the straight line method of providing for depreciation and to adjust the motor vehicles provision for depreciation at 1 January 19_4 in accordance with the new policy. In future, depreciation will be provided annually at the rate of 20% of the original cost of motor vehicles at each accounting year end.

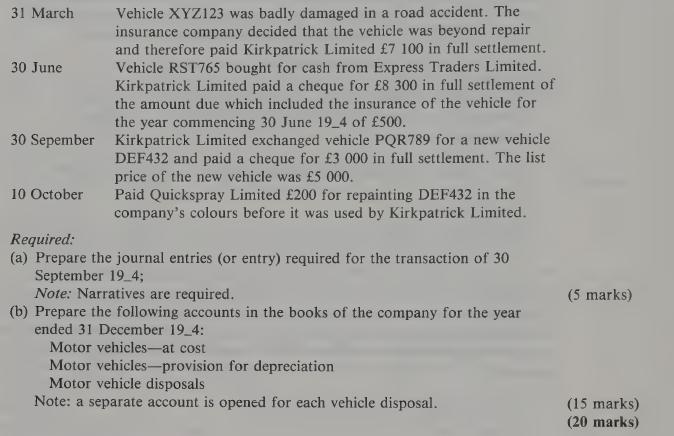

During 19_4, the following transactions took place involving motor vehicles (fixed assets):

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir