Ones November, 19_3, the Treasurer of the Olympiad Athletics Club died. The financial year of the club,

Question:

Ones November, 19_3, the Treasurer of the Olympiad Athletics Club died.

The financial year of the club, which had been formed to provide training facilities for both field and track event athletes, had ended two days previously on 31 October 19_3. An extraordinary general meeting was convened for the purpose of appointing a new treasurer whose task it would be to prepare the annual accounts for that financial year.

An enthusiastic club member, Guy Rowppe, was duly appointed but, having only an elementary knowledge of book-keeping, soon found himself in difficulty.

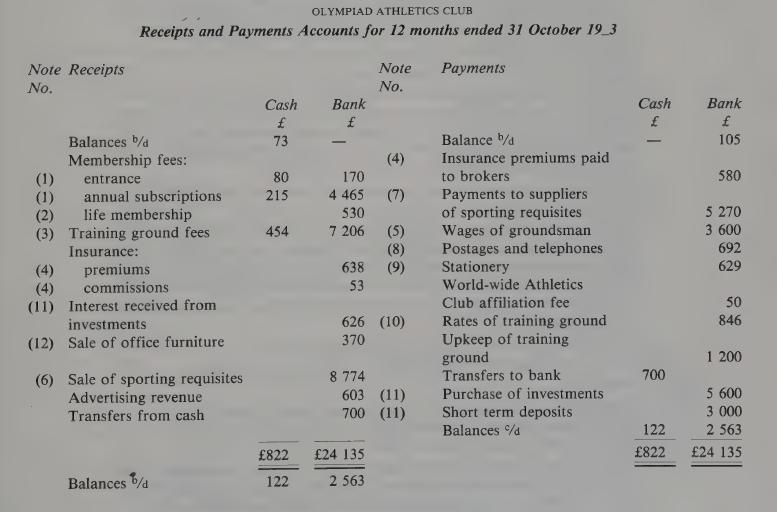

He sought your assistance which you agreed to give. During your conversation he said, ‘The previous treasurer maintained a Cash and Bank account. I have summarised the detailed entries into what I think you call a Receipts and Payments Account, and have rounded the figures to the nearest £1.’

At this point he supplied you with a copy of the following document:

After you had perused the above account, Guy Rowppe explained the numbered items, as follows:

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

On admittance to membership of the club, new members pay an initial entrance fee together with their annual subscription. At 31 October 19_2, annual subscriptions of £70 had been paid in advance and £180 was owing but unpaid; of this latter amount, £40 related to members who left during the current year and is now no longer recoverable. The figures at 31 October 19_3 are £100 subscriptions in advance and £230 in arrear. The policy of the club is to take credit for subscriptions when due and to write off irrecoverable amounts as they arise.

As an alternative to paying annual subscriptions, members can at any time opt to pay a lump sum which gives them membership for life without further payment. Amounts so received are held in suspense in a Life Membership Fund account and then credited to Income and Expenditure Account in equal instalments over 10 years; the first such transfer takes place in the year in which the lump sum is received. On 31 October 19_2 the credit balance on the Life Membership Fund Account was £4 720, of which £850 was credited as income for year ended 31 October 19_3.

The club has a permanent training ground. Non-members can use the facilities on payment of a fee. In order to guarantee a particular facility, advance booking is allowed. Advance booking fees received before 31 October 19_3 in respect of 19_4 total £470. The corresponding amount paid up to 31 October 19_2 in advance of 19_3 was £325. Members can use the facilities free of charge.

Club members can take out insurances through the club at advantageous rates. Initially, premiums are paid by members to the club. Subsequently, the club pays the premiums to an insurance broker and receives commission. At 31 October 19_2 premiums received but not yet paid over to the broker amounted to £102 and commissions due but not yet received were £11. The corresponding amounts at 31 October 19_3 are £160 and £13 respectively.

The groundsman is employed for the six months April to September ‘

only. He is then paid a retaining fee to secure his services for the following year. At 31 October 19_2 the groundsman had been paid a retainer (£250) for 19_3. Included in the Wages figure (£3,600) is the retainer (£300) for 19_4.

Sporting requisites are sold only on cash terms. There are therefore no debtors for these items.

On 31 October 19_2 sums owed to suppliers of sporting requisites totalled £163; the corresponding figure on 31 October 19_3 was £202.

Stock of unsold sporting requisites on 31 October 19_2 was £811 and on 31 October 19_3, was £927. In arriving at this latter figure, the sum of £137, representing damaged and unsaleable stock at cost price, had been excluded.

Postage stamps unused at 31 October 19_3, totalled £4.

Stock of stationery on 31 October 19_2 and 19_3 was £55 and £36 respectively.

Rates are payable to the District Council in two instalments (in advance) each year. £360 had been paid on 1 October 19_2, £390 on 1 April 19_3 and £456 on 1 October 19_3.

The club receives interest on investments bought a number of years ago at a cost of £7 400 (current valuation £7 550). At the end of October 19_3, the club had acquired further investments which cost £5 600 (current valuation £5 600) and at the same time placed £3 000 in a short-term deposit account.

(12) The written down value of the furniture which had been sold during the year was £350; it had originally cost £800.

Other Matters: é

Initially, the training ground had been acquired freehold* from a farmer at an inclusive cost of £4 000. Subsequently, the club had some timber buildings erected to provide various facilities for members. The total cost of these buildings was £35 000; depreciation is calculated at the rate of 10%

per annum on a straight line basis. At 31 October 19_2, the provision for depreciation account had a balance of £9 400.

At 31 October 192, the furniture and equipment etc. was recorded in the club’s books as £7 900 (cost) against which there was a provision for depreciation of £4 150 (calculated on the same basis as for buildings). Apart from the disposal referred to in note (12) (above) there had been no other disposals or acquisitions during the year.

Required:

Prepare the club’s Income and Expenditure Account for year ended 31 October 19_3 and the Balance Sheet at that date.

All workings must be shown.

115 (32 marks)

* Freehold land is land held in perpetuity.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir