Rainy plc is considering investing in a machine to manufacture a new line of umbrellas. The following

Question:

Rainy plc is considering investing in a machine to manufacture a new line of umbrellas. The following data has been assembled in respect of the investment:

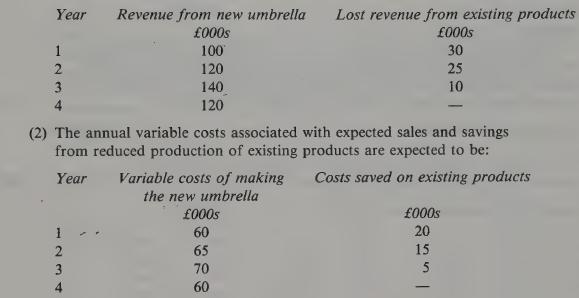

(1) Market research has just been carried out at a cost of £20 000. The study estimated the revenue from the new umbrella and the effect on existing products to be:

(3) Fixed costs such as rent, rates, etc. which are unaffected by the investment will be £50 000 per year.

(4) The machine to be used will cost £120 000 payable immediately. It will be depreciated using the straight line method. The residual value will be nil.

(5) The cost of capital is 12%.

Required:

(a) Calculate the NPV of the project. Should Rainy ple invest? (10 marks)

(b) Briefly, explain why the NPV method is superior to the ROCE and Payback approaches.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir