The trial balance of YMB plc at 30th June, 19_5 was as follows: You are given the

Question:

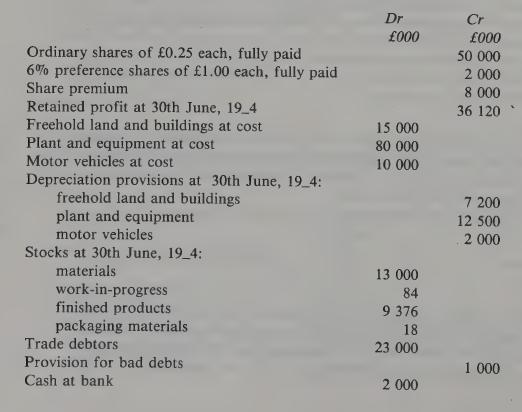

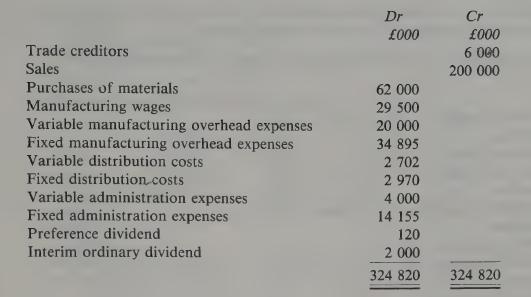

The trial balance of YMB plc at 30th June, 19_5 was as follows:

You are given the following information:

(1) There were no additions to fixed assets during the year.

(2) Freehold land and buildings are to be depreciated at the rate of 2% per annum by the straight line method, assuming no residual value.

(3) Plant and equipment are to be depreciated at the rate of 10% per annum on cost.

(4) Motor vehicles are to be depreciated at the rate of 25% per annum by the diminishing (reducing) balance method.

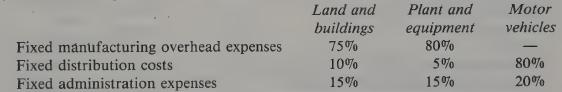

(5) The annual depreciation charges are to be allocated as follows:

(6) The bad debts provision is to be increased by an amount equal to one per cent of sales. The item is to be regarded as variable distribution cost.

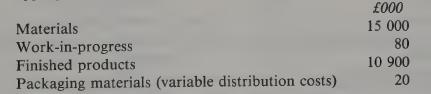

(7) Stocks at 30th June, 19_5, valued at full manufacturing cost where appropriate, were:

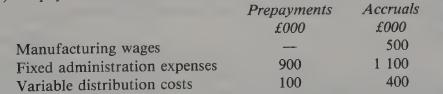

(8) Prepayments and accruals at 30th June, 19_5 were:

(9) Provision is to be made for corporation tax at the rate of 50% of the net profit (advance corporation tax is to be ignored) and a final ordinary dividend of £0.02 per share.

You are required to prepare, for YMB ple’s internal purposes, the follawing historic cost financial statements:

(a) a manufacturing, trading and profit and loss account, in vertical and columnar form, for the year ended 30th June, 19_5; (22 marks)

(b) a balance sheet, in vertical and columnar form, as at that date.

Step by Step Answer:

Accounting Costing And Management

ISBN: 9780198328230

2nd Edition

Authors: Riad Izhar, Janet Hontoir