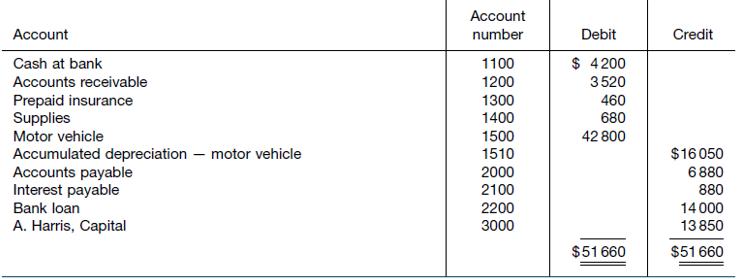

Andy Harris owns Piano Tuning Service. The post-closing trial balance at 30 June 2025 is shown below.

Question:

Andy Harris owns Piano Tuning Service. The post-closing trial balance at 30 June 2025 is shown below. Ignore GST.

Transactions completed during the year ended 30 June 2026 are summarised below.

1. Tuning fees of \($78\) 000 were receivable during the year; \($42\) 700 of this total was received in cash. The remainder consisted of transactions on credit.

2. Revenue from piano repairs was \($48\) 700. Cash received totalled \($33\) 500, and accounts receivable increased by \($15\) 200.

3. Supplies costing \($820\) were purchased during the year on credit.

4. On 1 January 2026, Andy Harris paid \($6000\) off the bank loan plus interest of \($1800.\) The interest payment consisted of \($880\) accrued up to 1 July 2025 and a further \($920\) which accrued for the period to 31 December 2025.

5. Fuel for the vehicle cost \($5200\) in cash.

6. Insurance on the vehicle, paid in advance, was \($1260\).

7. Telephone expense of \($1480\) was paid.

8. Accounts receivable of \($47\) 800 were collected, and \($4000\) was paid on accounts payable.

9. Andy Harris withdrew \($48\) 000 cash from the business.

The following information relating to adjusting entries is available at the end of June 2026.

10. A physical count showed supplies costing \($400\) on hand at 30 June 2026.

11. Accrued interest on the bank loan is \($420\).

12. Insurance costing \($1200\) expired during the year.

13. Depreciation on the vehicle is \($8700\).

14. The June telephone account for \($264\) has not been paid or recorded.

Required

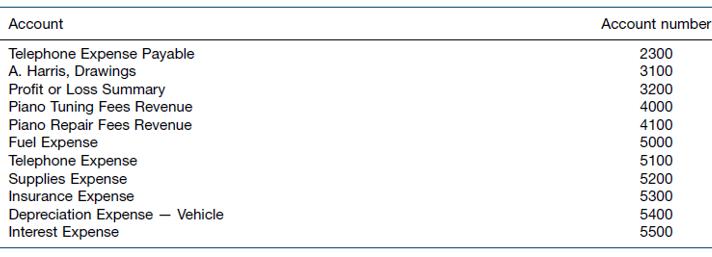

(a) Open T accounts for the accounts listed in the post-closing trial balance and the accounts below. Insert beginning balances in the accounts as shown in the post-closing trial balance.

(b) Prepare journal entries to record the transactions (numbers 1–9) completed in the year to 30 June 2026.

(c) Post the entries to T accounts.

(d) Prepare a 10-column worksheet.

(e) Prepare and post the adjusting entries.

(f) Prepare an income statement, statement of changes in equity and a balance sheet.

(g) Prepare and post the closing entries.

(h) Prepare a post-closing trial balance.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie