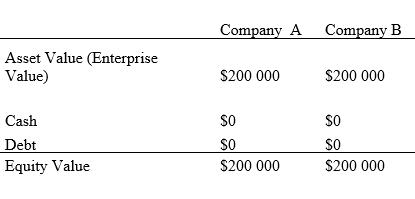

Consider Company A and Company B that are both all equity financed and have identical enterprise values.

Question:

Consider Company A and Company B that are both all equity financed and have identical enterprise values.

Required

(a) Assume that asset values remain but Company A has $50 000 in debt and $15 000 cash and Company B has $180 000 in debt and zero cash holding. Determine the impact of different capital structures on the equity value of Company A and Company B.

(b) The Commonwealth Bank notes that fundamental analysis can help you manager your stock portfolio. Fundamental analysis involves ‘number-crunching, which is about looking at the financial aspects of the company and seeing if factors such as revenue growth, debt and earnings stack up to form a picture for the future you are comfortable with’. However, it also involves ‘intangible elements that also impact a company’s performance, such as its management and strategy." (Commonwealth Bank https://www.commbank.com.au/articles/investing/what-is-fundamental-analysis.html). Discuss the limitations of fundamental analysis.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie