Crocker Company reported annual net income as follows: Analysis of its inventories revealed the following incorrect inventory

Question:

Crocker Company reported annual net income as follows:

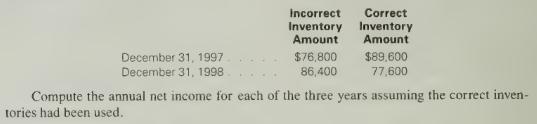

Analysis of its inventories revealed the following incorrect inventory amounts and these correct amounts: lo01

Transcribed Image Text:

1997 1998 $484,480 487,680 1999 409,984

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting A Business Perspective

ISBN: 9780075615859

7th Edition

Authors: Roger H. Hermanson, James Don Edwards, Michael W. Maher

Question Posted:

Students also viewed these Business questions

-

Instructions Complete Exercise 6from Chapter 6 Exercises and Problems which is attached as a PDF to this message. Presentthis exercise in Excel. SHORT ANSWER QUESTIONS, EXERCISES, AND PROBLEMS...

-

Crocker Company reported annual net income as follows: Analysis of its inventories revealed the following incorrect inventory amounts and these correct amounts: Compute the annual net income for each...

-

I need help for those question . E4.16 E18.4 E19.7 P22.4 E23.4 E18.10 E22.10 CHAPTER 4 EXERCISES: SET B E4-1B The trial balance columns of the worksheet for Lamar Company at June 30, 2017, are as...

-

Someone offered the investment options to Hendry on January 1, 2023: 1. Hendry has to save up to 5 times the initial deposit of US $ 150,000/year. 2. The savings cannot be taken for 20 years until...

-

Use the normal distribution in Exercise 15. (a) What percent of the men have a total cholesterol level less than 225 milligrams per deciliter of blood? (b) Out of 250 randomly selected U.S. men in...

-

Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): a. What is the maturity of the bond (in years)? b. What is the coupon rate (in...

-

Nordstrom, Inc. operates department stores in numerous states. Suppose selected fi nancial statement data (in millions) for 2017 are presented below. End of Year Beginning of Year Cash and cash...

-

Steuben Printing Inc. began printing operations on March 1. Jobs 3-01 and 3-02 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 3-03...

-

iew Policies urrent Attempt in Progress Identify each of the following organizational characteristics with the business organizational form or forms with which it is associated. (a) Easier to...

-

Using the data in Exercise 7-3 for Miami Discount Company, present a schedule showing the measurement of the ending inventory using LIFO perpetual inventory procedure. lo01

-

Should a company rely exclusively on the gross margin method to determine the ending inventory and cost of goods sold for the end-of-year financial statements? pg25

-

For December 31, 2012, the balance sheet of Baxter Corporation was as follows: Sales for 2013 were $245,000, and the cost of goods sold was 60 percent of sales. Selling and administrative expense was...

-

Malaysian Agrifood Corporation Berhad reported sales of RM 7 0 , 0 0 0 in May and RM 8 0 , 0 0 0 in June. The forecast sales for July, August and September are RM 9 0 , 0 0 0 , RM 1 0 0 , 0 0 0 , and...

-

1. Refer to the \"Plotting Data\" lesson (end of "Patterns to Notice") and plot the "Skydiver Velocity vs. Time\" data (taken from the video) on the following graph. to c) d) e) f) 9) Which is the...

-

The Star Company is considering a change in its credit terms to increase sales. Its current credit sales are $8.5 million per year and its present credit terms are 2/16 net of 20 basis. Discount is...

-

Determine the shear flow distribution for a torque of 57265.0Nm applied to the three cell section shown in the figure below. Note that the section has a constant shear modulus throughout. All answers...

-

2 a) Figure 1 shows the orientation of the carbon fibre which is orientate at 0.A9 radians from the vertical plane. Draw and label the element's normal and shear stresses acting on the carbon fibre...

-

Enter the following column headings across the top of a sheet of paper: Enter the transaction/adjustment letter in the first column and show the effect, if any, of each transaction/adjustment on the...

-

Akramin just graduated with a Master of Engineering in Manufacturing Engineering and landed a new job in Melaka with a starting salary of RM 4,000 per month. There are a number of things that he...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

Study smarter with the SolutionInn App