Details of Troy Horse Ltds income statement for the past year are as follows. Required Consider each

Question:

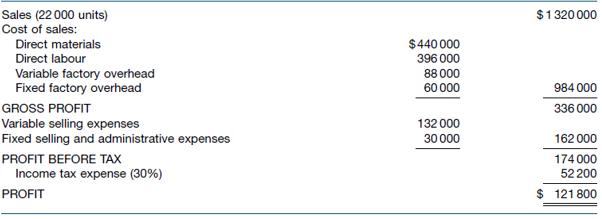

Details of Troy Horse Ltd’s income statement for the past year are as follows.

Required

Consider each of the following independent situations.

(a) Determine the company’s break-even point in units and sales dollars. What is the margin of safety?

(b) If the company wants to make an after-tax profit of \($109\) 200, what is the dollar level of sales necessary to reach its goal?

(c) If the sales volume is 15 000 units, what is the selling price needed to achieve an after-tax profit of \($109\) 200

(d) If the company’s sales volume increases by 10% as a result of increasing fixed selling expenses by \($30\) 000 and variable selling expenses by \($0.60\) per unit, what is the company’s after-tax profit?

(e) If direct material costs increase 10%, direct labour costs increase 15%, variable overhead costs increase 10%, and fixed overhead increases by \($10\) 000, how many units must be sold to earn an after-tax profit of \($89\) 600? Round your calculations to the next highest unit.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie