Foodies Warehouse Supplies Ltd has traditionally made sales for cash and on credit only. Management has resisted

Question:

Foodies Warehouse Supplies Ltd has traditionally made sales for cash and on credit only. Management has resisted accepting credit cards on the basis that the business would lose on average a credit card fee of 3% of the sale value, adversely affecting already low profit margins.

Management has become concerned at negative customer reaction to the policy of not accepting credit cards and, indeed, suspects that sales are being lost because of this policy.

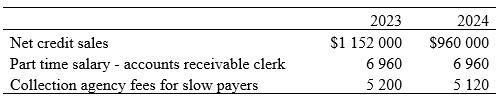

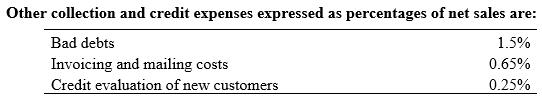

Management has asked you to provide a table showing credit and collection costs in dollars and as a percentage of net sales associated with credit sales and maintaining accounts receivable. The following data have been provided for the two most recent years which are expected to be representative of future operations.

It is also estimated that the average accounts receivable balance during the year is approximately 5% of net credit sales, and that surplus cash can be invested at 2.6% p.a. It is also known that credit card companies pay on average 98% of the sale within 2 business days of the date of sale.

Required:

(a) Prepare a table setting out for each year all of the credit and collection expenses both in dollars and as a percentage of net sales.

(b) Estimate, as a percentage of net credit sales, the cost of the interest forgone in carrying accounts receivable. (Ignore the 4-day gap for the purpose of calculation).

(c) Explain how credit cards and other forms of payment may be a means of disposing of accounts receivable.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie