Gnarly Nails Ltd sells manicure sets, nail polish and hand lotions. All sales are conducted on a

Question:

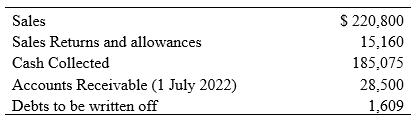

Gnarly Nails Ltd sells manicure sets, nail polish and hand lotions. All sales are conducted on a credit basis. The business does not allow cash discounts for prompt payment. Ignore GST. The following information was extracted from the accounting records at 30 June 2023.

Required:

(b) Assume that Gnarly Nails uses the direct write-off method of accounting for bad debts.

i. Show the general journal entry required to write-off the bad debts.

ii. What amount would be shown for bad debts expense in the statement of profit or loss at 30 June 2023?

iii. What amount would be shown for accounts receivable in the statement of financial position at 30 June 2023?

(c) Assume that Gnarly Nails the allowance method of accounting for bad debts and the Allowance for Doubtful Debts account had a credit balance of $900 at 1 July 2022. Also assume that an allowance of 2% of net credit sales is required at 30 June 2023.

i. Show the general journal entries required to write off the bad debts and bring in the required allowance for doubtful debts.

ii. What amount would be shown for bad debts expense in the statement of profit or loss at 30 June 2023?

iii. What amount would be shown for accounts receivable in the statement of financial position at 30 June 2023?

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie