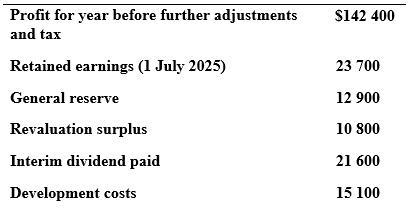

Hassink Ltd presented the following information for the year ending 30 June 2026 in the companys records.

Question:

Hassink Ltd presented the following information for the year ending 30 June 2026 in the company’s records.

On 30 June 2026, the directors decided to:

1. recommend a final cash dividend of \($30\) 200, to be ratified by shareholders at the annual general meeting

2. increase the general reserve by \($4300\) 3. write off development costs 4. provide for an estimated tax expense and current tax liability of \($32\) 400 on 2025–26 profits.

Required

Record the above adjustments in ledger accounts and prepare a statement of changes in equity for Hassink Ltd for the year ended 30 June 2026.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie

Question Posted: