Heidi Jones, an accountant, had the following transactions related to the business during June. Ignore GST. Required

Question:

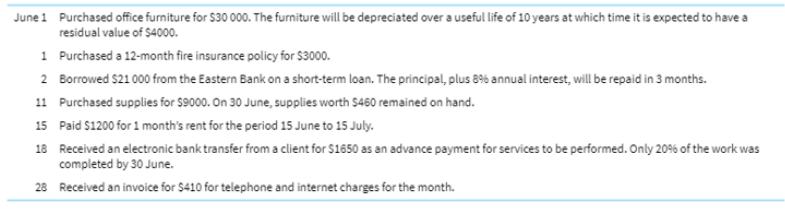

Heidi Jones, an accountant, had the following transactions related to the business during June. Ignore GST.

Required

(a) Prepare the journal entries to record each transaction and prepare any adjusting entries as at 30 June, the end of the accounting year. Ignore GST.

(b) Assuming the addition of 10% GST where necessary. Assume the telephone tax invoice for $451 was issued on 28 June.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie

Question Posted: