Question:

In January 2024, the management of Newlands Ltd decided to expand the business. On 1 July 2024, the company had $768 900 in retained earnings, and another reserve totalling $512 600 had been set aside for the acquisition of equipment out of retained earnings. Share capital consisted of 2 390 000 shares issued for $1 each. The following events occurred in relation to the equity accounts of Newlands Ltd over the next few years.

Required

(a) Prepare journal entries to record all transactions and events across the three year period.

(b) Show the equity section of the balance sheet of Newlands Ltd at 31 December 2027.

Transcribed Image Text:

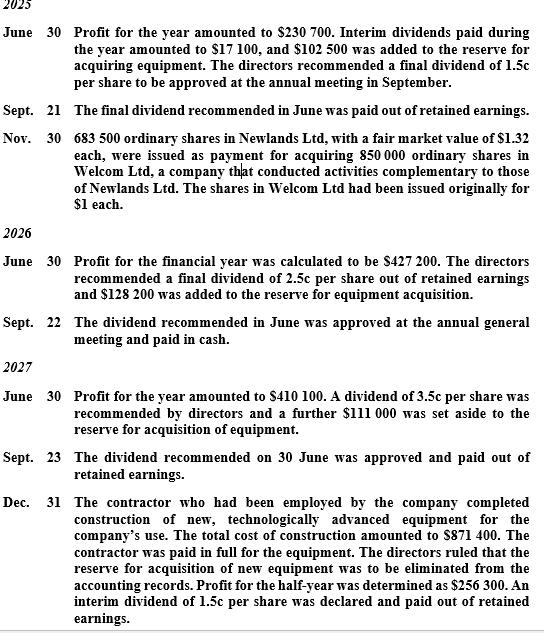

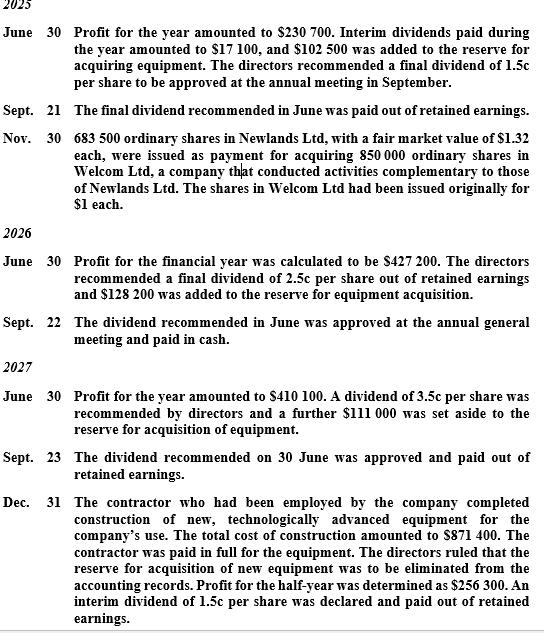

2025 June 30 Profit for the year amounted to $230 700. Interim dividends paid during the year amounted to $17 100, and $102 500 was added to the reserve for acquiring equipment. The directors recommended a final dividend of 1.5c per share to be approved at the annual meeting in September. Sept. 21 The final dividend recommended in June was paid out of retained earnings. Nov. 30 683 500 ordinary shares in Newlands Ltd, with a fair market value of $1.32 each, were issued as payment for acquiring 850 000 ordinary shares in Welcom Ltd, a company that conducted activities complementary to those of Newlands Ltd. The shares in Welcom Ltd had been issued originally for $1 each. 2026 June 30 Profit for the financial year was calculated to be $427 200. The directors recommended a final dividend of 2.5c per share out of retained earnings and $128 200 was added to the reserve for equipment acquisition. Sept. 22 The dividend recommended in June was approved at the annual general meeting and paid in cash. 2027 June 30 Profit for the year amounted to $410 100. A dividend of 3.5c per share was recommended by directors and a further $111 000 was set aside to the reserve for acquisition of equipment. Sept. 23 The dividend recommended on 30 June was approved and paid out of retained earnings. Dec. 31 The contractor who had been employed by the company completed construction of new, technologically advanced equipment for the company's use. The total cost of construction amounted to $871 400. The contractor was paid in full for the equipment. The directors ruled that the reserve for acquisition of new equipment was to be eliminated from the accounting records. Profit for the half-year was determined as $256 300. An interim dividend of 1.5c per share was declared and paid out of retained earnings.