Kimberley, Kerry and Kevin, partners trading as Triple K Traders have a partnership deed which includes the

Question:

Kimberley, Kerry and Kevin, partners trading as Triple K Traders have a partnership deed which includes the following provisions.

1. Salaries are to be allowed: Kimberley, \($54000;\) Kerry, \($46000;\) Kevin, \($38000.

2.\) Kerry is to receive a bonus of 15% of the profits after allowing for partners’ salaries and interest.

3. Interest is to be allowed on advances by partners at 8% p.a.

4. Interest on drawings to be charged at 10% p.a.

5. Residual profits are to be divided: Kimberley, 3/8; Kerry, 3/8; Kevin, 1/4.

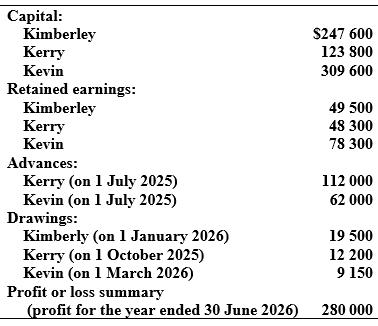

Account balances at 30 June 2026 before any adjustment in respect of provisions (1) to (5) include the following.

Required

(a) Prepare a schedule showing the distribution of final profit to each partner

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie