Prickly Pear Ltd wishes to prepare a cash budget for the first quarter of 2025. In response

Question:

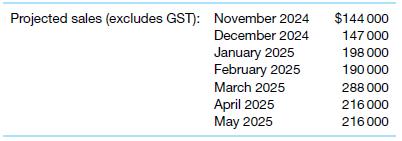

Prickly Pear Ltd wishes to prepare a cash budget for the first quarter of 2025. In response to your request for past and projected financial data, you receive the following:

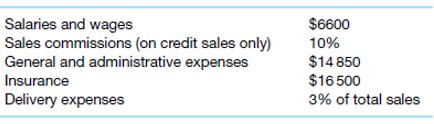

Of sales, 70% of sales are on credit, with 65% collected during the month of sale, 30% collected during the month following the sale, and 5% during the second month after the sale; 30% of the projected sales are for cash. Ignore GST. Since all suppliers require substantial lead time, purchases of inventory are made 2 months in advance of sale and are paid for 1 month in advance of sale. The cost of sales is 50% of the selling price. Other regular monthly cash payments (ignoring GST) are as follows.

A special advertising campaign is planned that will require a cash payment of \($16\) 650 on 1 March. An interim dividend of \($13\) 500 is planned for payment on 16 February.

On 1 January 2025, there was an outstanding bank debt of \($90\) 000 that must be paid off in 5 months by making principal repayments of \($18\) 000 at the end of each month. Interest is payable at the end of each month at 1% per month on the balance outstanding at the beginning of the month. The cash balance on 1 January is estimated to be \($112\) 500.

Required Prepare the cash budget of Prickly Pear Ltd covering January, February and March 2025.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie