Question:

Seeview Travels Ltd owns two touring coaches. The company chooses to use the units of production method of accounting for depreciation where possible. The financial year ends on 30 June. The following events and transactions occurred during the first 3 years of operations. Ignore GST.

Required Prepare the general journal entries to record the transactions of Seeview Travels Ltd from 1 July 2023 to 30 June 2026. Round calculations to the nearest dollar.

Transcribed Image Text:

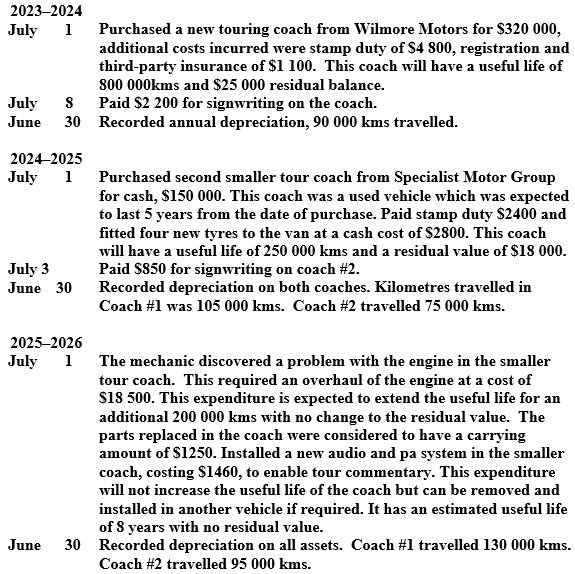

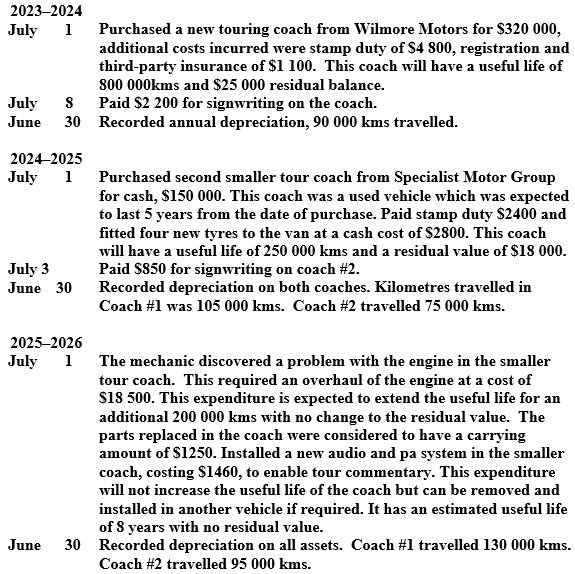

2023-2024 July 1 July 8 June 30 Purchased a new touring coach from Wilmore Motors for $320 000, additional costs incurred were stamp duty of $4 800, registration and third-party insurance of $1 100. This coach will have a useful life of 800 000kms and $25 000 residual balance. Paid $2 200 for signwriting on the coach. Recorded annual depreciation, 90 000 kms travelled. 2024-2025 July 1 July 3 June 30 Purchased second smaller tour coach from Specialist Motor Group for cash, $150 000. This coach was a used vehicle which was expected to last 5 years from the date of purchase. Paid stamp duty $2400 and fitted four new tyres to the van at a cash cost of $2800. This coach will have a useful life of 250 000 kms and a residual value of $18 000. Paid $850 for signwriting on coach #2. Recorded depreciation on both coaches. Kilometres travelled in Coach #1 was 105 000 kms. Coach # 2 travelled 75 000 kms. 2025-2026 July 1 The mechanic discovered a problem with the engine in the smaller tour coach. This required an overhaul of the engine at a cost of $18 500. This expenditure is expected to extend the useful life for an additional 200 000 kms with no change to the residual value. The parts replaced in the coach were considered to have a carrying amount of $1250. Installed a new audio and pa system in the smaller coach, costing $1460, to enable tour commentary. This expenditure will not increase the useful life of the coach but can be removed and installed in another vehicle if required. It has an estimated useful life of 8 years with no residual value. June 30 Recorded depreciation on all assets. Coach #1 travelled 130 000 kms. Coach #2 travelled 95 000 kms.