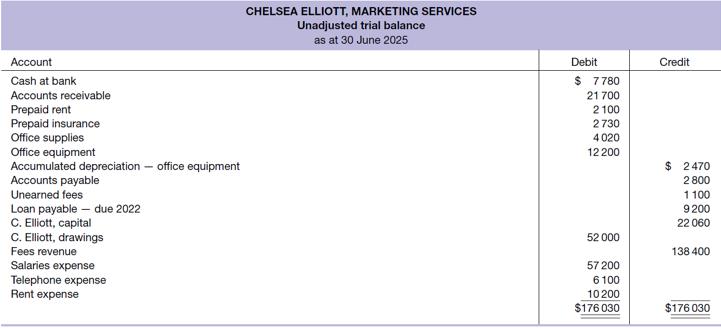

The trial balance of Chelsea Elliott, marketing services provider, at 30 June 2025 was as follows (ignore

Question:

The trial balance of Chelsea Elliott, marketing services provider, at 30 June 2025 was as follows (ignore GST).

Required

(a) Using the following information, prepare adjusting entries. Use the accounts shown in the trial balance and these additional accounts: Salaries Payable, Interest Payable, Telephone Account Payable, Depreciation Expense, Office Supplies Expense, Insurance Expense, Interest Expense.

(a) Interest expense of $520 has accrued on the loan payable.

(b) A physical count of office supplies on 30 June shows $560 of unused supplies on hand.

(c) Depreciation of the office equipment this year is estimated to be $1020.

(d) Half the amount in the Unearned Fees account had been earned by the end of the year.

(e) The amount in the Prepaid Rent account covers this June and the next 2 months.

(f) Of prepaid insurance, 80% expired this period.

(g) Salaries expense accrued for the last 4 days in June amounts to $1660.

(h) The telephone expense for June of $670 has not been recorded or paid. No tax invoice has been issued.

(b) Open T accounts for the accounts shown in the trial balance and enter the 30 June balance in each account. Post the adjusting entries to the T accounts.

(c) Prepare an adjusted trial balance, an income statement and a statement of financial position.

(d) Assuming that adjusting entries 1–8 in requirement

(a) were not made, determine what the profit would have been. What is the difference between this figure and the profit derived in requirement (c)?

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie