Becky owns a shoe shop. During May 2014 she received the following purchase invoices. Prepare the following

Question:

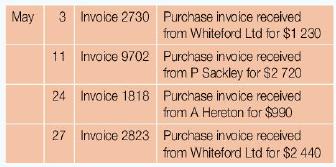

Becky owns a shoe shop. During May 2014 she received the following purchase invoices.

Prepare the following accounting records to record these transactions:

• Purchases journal

• Trade payable accounts in the purchases ledger

• Purchases account in the general ledger.

Transcribed Image Text:

3 invoice 2730 Purchase invoice received from Whiteford Ltd for $1 230 May 11 Invoice 9702 Purchase invoice received from P Sackley for $2 720 24 Invoice 1818 Purchase invoice received from A Hereton for $990 27 Invaice 2823 Purchase invoice received from Whiteford Ltd for $2 440

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

Purchases Journal Date Invoice No Supplier Amount ...View the full answer

Answered By

Chandrasekhar Karri

I have tutored students in accounting at the high school and college levels. I have developed strong teaching methods, which allow me to effectively explain complex accounting concepts to students. Additionally, I am committed to helping students reach their academic goals and providing them with the necessary tools to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Accounting For Cambridge International AS And A Level

ISBN: 9780198399711

1st Edition

Authors: Jacqueline Halls Bryan, Peter Hailstone

Question Posted:

Students also viewed these Business questions

-

Prepare the journal entries to record these transactions on Allied Companys books using a periodic inventory system. (a) On March 2, Allied Company purchased $1,000,000 of merchandise from B....

-

Prepare the journal entries to record these transactions on Koeller Companys books using a periodic inventory system. (a) On March 2, Koeller Company purchased $800,000 of merchandise from Reeves...

-

Prepare the journal entries to record these transactions on Jerel Companys books using a periodic inventory system. (a) On March 2, Jerel Company purchased $900,000 of merchandise from McNeal...

-

On January 1, 2021, Access IT Company exchanged $980,000 for 40 percent of the outstanding voting stock of Net Connect. Especially attractive to Access IT was a research project underway at Net...

-

Write the chemical equation that represents the dissociation of (NH4)2S.

-

The Lake Placid Town Council decided to build a new community center to be used for conventions, concerts, and other public events, but considerable controversy surrounds the appropriate size. Many...

-

P 12-1 The economics of derivatives Wang Corporation enters into a forward agreement with Sung Corporation on April 1, 2016, to buy 250,000 gallons of fuel oil at $3.52 on December 31, 2016. At the...

-

Biofuel Inc. (BI) is a private company that just started up this year. The company's owner, Sarah Biorini, created a process whereby carbon dioxide (CO,) emissions are converted into biofuel....

-

Score: 0 of 4 pts 2 of 2 (0 complete) HW Score: 0%, 0 of 10 pts Question Help O E5-23 (similar to) Sander Company produces mathematical and financial calculators and operates at capacity. Data...

-

A home improvement retail store is offering its customers store-branded credit cards that come with a deep discount when used to purchase in-store home improvement products. To maintain the...

-

Prepare a trial balance Salim runs a business selling books. He has extracted a trial balance at 30 April 2014 but has not yet included the following balances. Required Complete the trial balance...

-

Faye is a florist. The following information is available for the year ended 30 November 2014. Prepare the trading section of an income statement for the year ended 30 November 2014. $ Inventory at 1...

-

The bookstore staff at Pleasant Creek Community College works hard to satisfy students, instructors, and the schools business office. Instructors specify textbooks for particular courses, and the...

-

Sams old friend Dot is considering setting up a business offering historical boating trips along the River Thames. Dot thinks that she may be able to make a good living out of this. She has carried...

-

Arrow Industries employs a standard cost system in which direct materials inventory is carried at standard cost. Arrow has established the following standards for the direct costs of one unit of...

-

Explain the financial effect (increase, decrease, or no effect) of each of the following transactions on stockholders' equity: a. Purchased supplies for cash. b. Paid an account payable. c. Paid...

-

What type of account-asset, liability, stockholders' equity, dividend, revenue, or expense-is each of the following accounts? Indicate whether a debit entry or a credit entry increases the balance of...

-

Is it possible for an accounting transaction to only affect the left side of the accounting equation and still leave the equation in balance? If so, provide an example.

-

In the first year after its release, 83 percent of emergency room doctors were estimated to have tried Dermabond glue (an alternative to sutures in some situations). Which type of probability...

-

The executor of Gina Purcells estate has recorded the following information: Assets discovered at death (at fair value): Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Discuss the life cycle of a product in terms of its probable impact on a manufacturers marketing mix. Illustrate using personal computers.

-

What characteristics of a new product will help it to move through the early stages of the product life cycle more quickly? Briefly discuss each characteristic illustrating with a product of your...

-

What is a new product? Illustrate your answer.

-

Due to the relationship of financial statements, the statement of stockholders' equity links the income statement to the balance sheet. True or False?

-

Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An...

-

Trey is single and has no qualifying child. His adjusted gross income is $12,355. In order to claim the Earned Income Tax Credit, he must meet which of the following requirements? He cannot be the...

Study smarter with the SolutionInn App