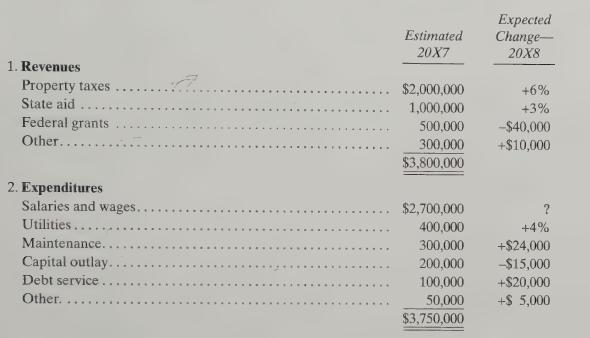

(Operating Budget Preparation) The finance director of the Bethandy Independent School District is making preliminary estimates of...

Question:

(Operating Budget Preparation) The finance director of the Bethandy Independent School District is making preliminary estimates of the budget outlook for the General Fund for the 20X8 fiscal year. These estimates will permit the superintendent to advise the department heads properly when budget instructions and forms are distributed. She has assembled the following information:

3. Fund balance at the end of 20X7 is expected to be $1,600,000; at least $1,500,000 must be available at the end of 20X8 for carryover to help finance 20X9 operations.

a. Prepare a draft operating budget for the Bethandy Independent School District for the Required 20X8 fiscal year—including 20X7 comparative data and expected change computations.

Assume that 20X8 appropriations are to equal 20X8 estimated revenues.

b. What total salaries and wages amount and average percentage increase or decrease are implied in the draft operating budget prepared in part (a)? What are the maximum salary and wages amount and percentage increase that seem to be feasible in 20X8?

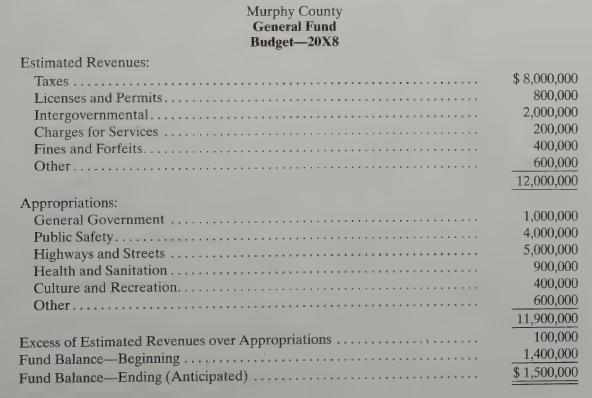

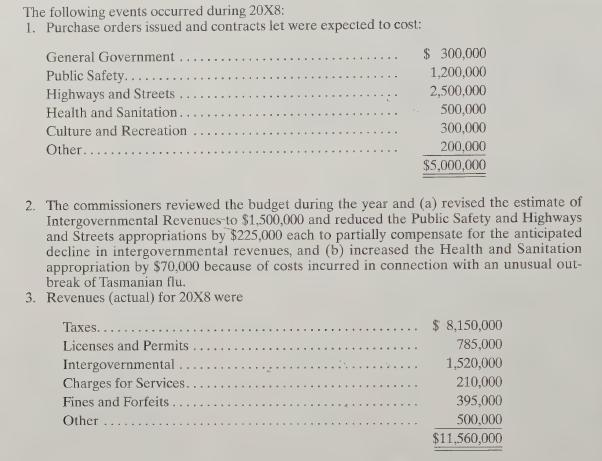

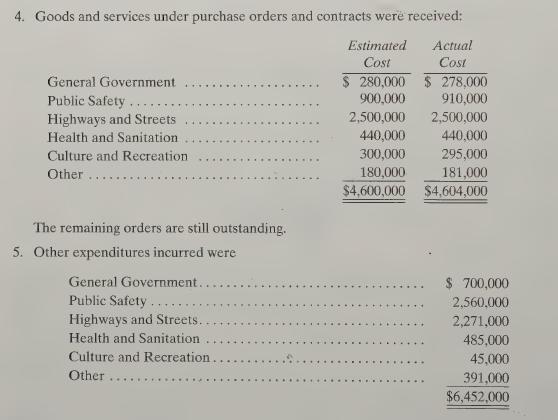

(Budgetary and Other Entries—General and Subsidiary Ledgers) The Murphy County Commissioners adopted the following General Fund budget for the 20X8 fiscal year:

Required 1. Set up general ledger T-accounts and also revenues and expenditures subsidiary ledgers like those in Illustrations 4-3 and 4-4. 2. Record the Murphy County 20X8 General Fund budget in the general ledger and subsidiary ledger accounts, keying these entries "B" (for budget). Then record the numbered transactions and events, keying these entries by those numbers.

Step by Step Answer:

Governmental And Nonprofit Accounting Theory And Practice

ISBN: 9780132552721

9th Edition

Authors: Robert J Freeman, Craig D Shoulders, Gregory S Allison, Terry K Patton, Robert Smith,