5.8 The following is an extract from Barrows balance sheet at 31 August 2008: Barrows depreciation policy

Question:

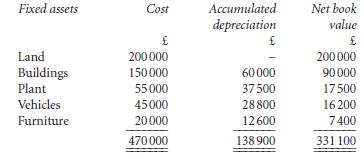

5.8 The following is an extract from Barrow’s balance sheet at 31 August 2008:

Barrow’s depreciation policy is as follows:

1 a full year’s depreciation is charged in the year of acquisition, but none in the year of disposal;

2 no depreciation is charged on land;

3 buildings are depreciated at an annual rate of 2 per cent on cost;

4 plant is depreciated at an annual rate of 5 per cent on cost after allowing for an estimated residual value of £5000;

5 vehicles are depreciated on a reduced balance basis at an annual rate of 40 per cent on the reduced balance;

6 furniture is depreciated on a straight-line basis at an annual rate of 10 per cent on cost after allowing for an estimated residual value of £2000.

Additional information:

1 During the year to 31 August 2009, new furniture was purchased for the office. It cost £3000 and it is to be depreciated on the same basis as the old furniture. Its estimated residual value is £300.

2 There were no additions to, or disposals of, any other fixed assets during the year to 31 August 2009.

Required:

(a) Calculate the depreciation charge for each of the fixed asset groupings for the year to 31 August 2009; and

(b) show how the fixed assets would appear in Barrow’s balance sheet as at 31 August 2009.

Step by Step Answer: