Nelson Ltd was incorporated in 2000 with an authorized share capital of 500 000 1 ordinary shares,

Question:

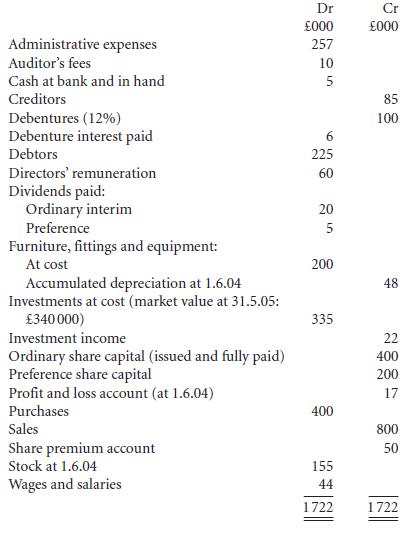

Nelson Ltd was incorporated in 2000 with an authorized share capital of 500 000 £1 ordinary shares, and 200 000 5% cumulative preference shares of £1 each. The following trial balance was extracted as at 31 May 2005:

Additional information:

1 Stock at 31 May 2005 was valued at £195 000.

2 Administrative expenses owing at 31 May 2005 amounted to £13 000.

3 Depreciation is to be charged on the furniture and fittings at a rate of 12g% on cost.

4 Salaries paid in advance amounted to £4000.

5 Corporation tax owing at 1.6.05 is estimated to be £8000.

6 Provision is to be made for a final ordinary dividend of 1.25p per share.

Required:

Prepare Nelson Ltd’s trading and profit and loss account for the year to 31 May 2005 and a balance sheet as at that date.

Step by Step Answer: