Prospect Limited is considering investing in some new plant. The plant would cost 1 000 000 to

Question:

Prospect Limited is considering investing in some new plant. The plant would cost

£1 000 000 to implement. It would last five years and it would then be sold for

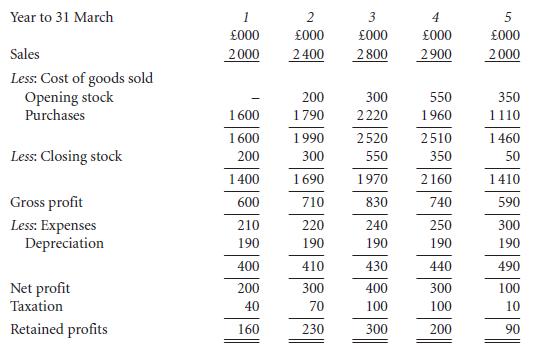

£50 000. The relevant profit and loss accounts for each year during the life of the project are as follows:

Additional information:

1 All sales are made and all purchases are obtained on credit terms.

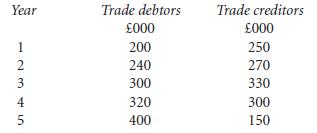

2 Outstanding trade debtors and trade creditors at the end of each year are expected to be as follows:

3 Expenses would all be paid in cash during each year in question.

4 Taxation would be paid on 1 January following each year end.

5 Half the plant would be paid for in cash on 1 April Year 0, and the remaining half (also in cash) on 1 January Year 1. The resale value of £50 000 will be received in cash on 31 March Year 6.

Required:

Calculate the annual net cash flow arising from the purchase of this new plant.

Step by Step Answer: