Question:

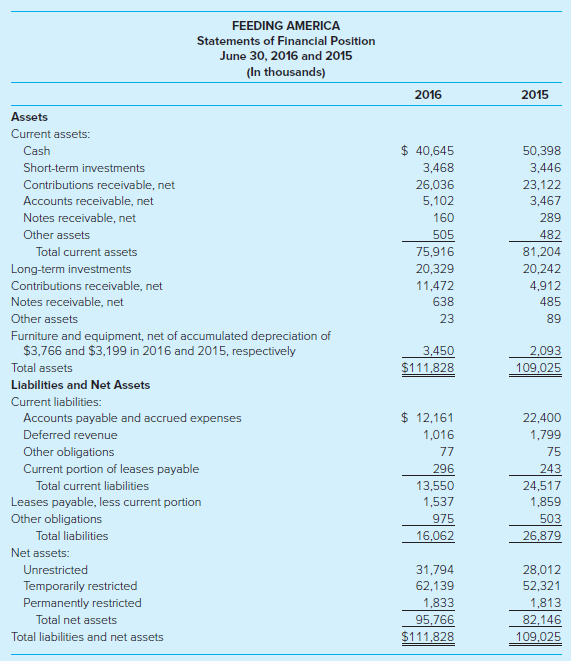

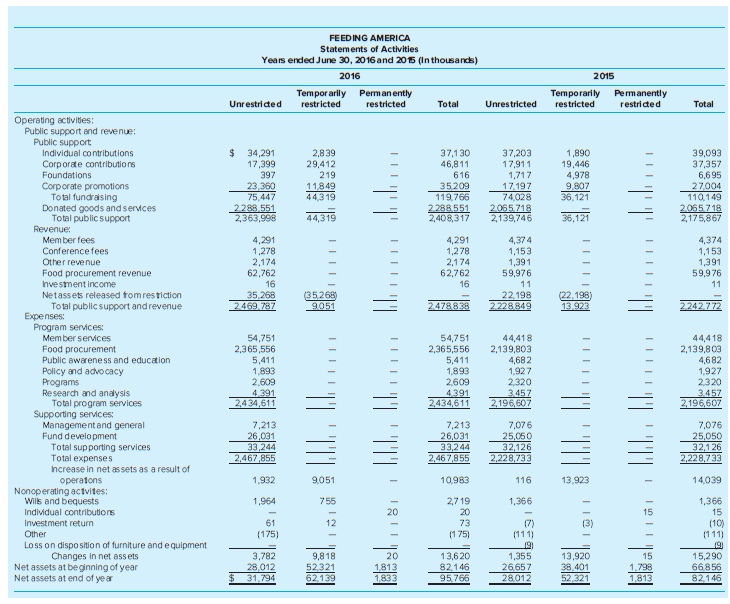

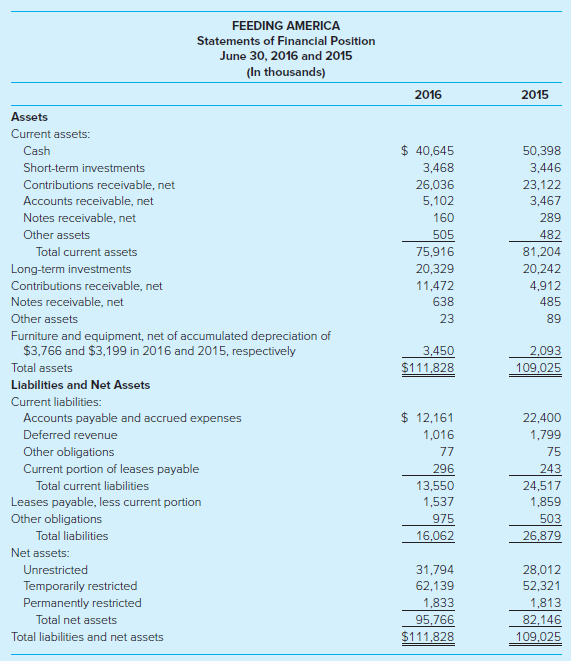

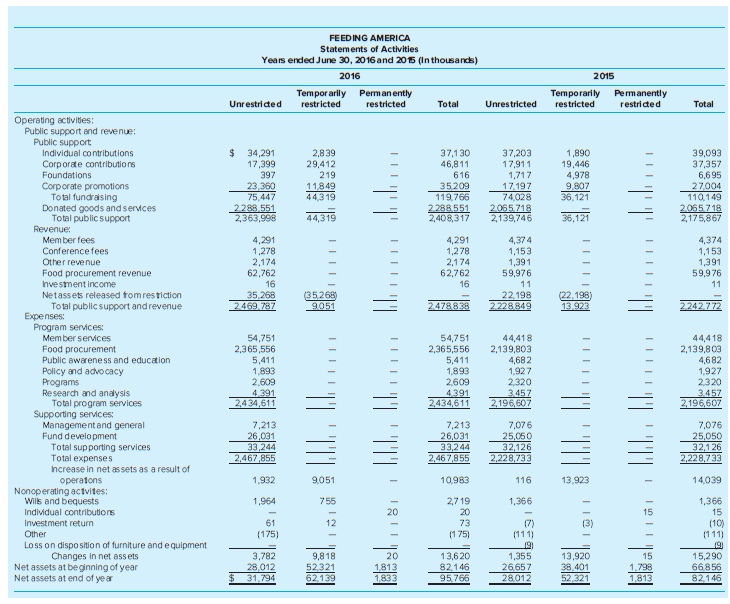

Information from the 2015 Form 990 and the 2016 audited

financial statements for Feeding America follows. Although Form 990 indicates it is for 2015, it is actually for the period July 1, 2015, to June 30, 2016, the same time period as the 2016 audited financial statement. Use the following information to complete the exercise.

Required

a. Compute the following performance measures using the Form 990 data presented in this exercise and comment on what information they convey to a potential donor without comparing them to prior years or other comparable agencies.

1. Current ratio€”liquidity.

2. Revenues/expenses€”going concern.

3. Program expenses/total expenses€”program effectiveness.

4. Public support/fund-raising expenses€”fund-raising efficiency.

b. Using the audited financial statements provided in this exercise, calculate the same ratios listed in requirement a. Comment on any differences.

c. Discuss the advantages of analyzing financial performance using audited annual financial statement information versus IRS Form 990 information.

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

FEEDING AMERICA, 2015 FORM 990 (PARTS VIII, IX, AND X) FEEDING AMERICA Form 000 (2015) 36-3673599 Page 9 Part VII Statement of Revenue Check If Schedule O contalnsa response or note to any line In this Part VIII. (C) Unreleted buainess revenue (A) Total revenue (B) Related or (D) Revenue excduded from tax under sections 512-514 exempt function revenue 1a Federated campaigns 1a b Membership dues O Fundralsing events d Related organizations • Govermment grants (contributions) - 1b 10 1d 1e * Al othe contritutons, gita, grants, and similer amounts not included above 11 ,5ב ,פרב ,2 2,200,046, 654 O Noncesh contributions induded in lines 10-1t S h Total. Add lines 1a-11. ..... 2,375, G35,007. Business Code 2a POOD FROCURBaT REVENUR 10,500, G0s. 18,500,409. MRR FERS 900099 4,290, 24. 4.290.024. CONFERENCE RIVENUE 1.278.147. 1,278,147. INTRREST INCOME 900099 1,02. 1,022. * All other program service revenue O Total. Add ihes 20-2 24,070,602. Investment Income (Including dividends, Interest, and other similar amounts). 511,301. 511.1. Income from Investment of tax-exempt bond proceeds Royalties 35, 209, 467. 35, 20, 467. 0) Real Penonal 8a Gross rents 157. 754 204,2 b Less: rental expenses O Rental income or (loss) d Net rental Income or (loss)- -46,501. -46,501. -46,501. 7a Gross amount from sales of 0 Secutses (i) Oher assets other than Inventory 134,343. b Less: cost or other basis 310,579. and sales expenses o Gain or (loss) 04,236. d Net gain or (loss) -104,236. -104, 236. 8a Gross Income from fundraising events (not including $ of contributions reported on Ine 1c). See Part IV, Ine 18. b Less: direct expenses • Net Income or (loss) from fundralsing events 8a Gross Income from gaming activities See Part V, Ilne 19 b Less: drect expenses • Net income or (loss) from gaming activities. 10a Gross sales of Inventory, less retums and allowances 44.261,941. b Less: cost of goods soid • Net Income or (loss) from sales of Inventory. 43, 720, 747. 541.194. 541.194. Miscelaneous Revenue Business Code 11a PURLICATIONS AND MATERIALS FRE 355, 097. dellER PEa 1.525.005. d All other revenue • Total. Add lines 11a-11d Total revenue. See instructions. 1.000.902. 12 35,499,03H. Fom 990 (2015) 2,417, 610,536. 26,492, G. JGA SE 1OI 1.000 Program Service Reven u and Other Similar Amounts Other Reenue