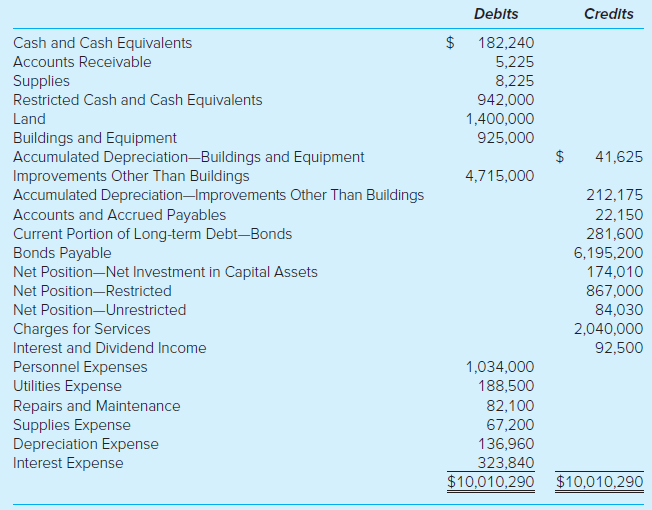

The City of Saltwater Beach established an enterprise fund two years ago to construct and operate Tribute

Question:

Additional information concerning the Tribute Aquatic Center Fund follows.

1. All bonds payable were used to acquire property, plant, and equipment.

2. Each year a payment is required on January 1 to retire an equal portion of the bonds payable.

3. Equipment was sold for cash at its carrying value of $9,250.

4. Total cash received from customers was $2,038,355 and cash received for interest and dividends was $92,500; of this amount, $75,000 was restricted cash. There were no other changes to restricted cash during the year.

5. Cash payments included $1,038,800 for personnel expenses, $185,800 for utilities, $86,225 for repairs and maintenance, $323,840 for interest on bonds, and $65,900 for supplies.

6. The beginning balance in Cash was $99,300, Accounts Receivable was $3,580, Supplies was $9,525, and Accounts and Accrued Payables was $28,375. Accrued Payables include personnel expenses, utilities, and repairs and maintenance.

7. The net position categories shown on the preclosing trial balance have not been updated to reflect correct balances at year-end.

Required

a. Prepare the statement of revenues, expenses, and changes in fund net position for the Tribute Aquatic Center for the year just ended.

b. Prepare the statement of net position for the Tribute Aquatic Center at year-end.

c. Prepare the statement of cash flows for the Tribute Aquatic Center at year-end.

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely