Washington City created an Information Technology department four years ago to centralize information technology (IT) functions for

Question:

During the current fiscal year ended December 31, the following transactions (summarized) occurred:

1. Gross employee wages were $57,600, including the employer€™s share of Social Security taxes amounting to $4,100. Federal income and Social Security taxes withheld from that amount totaled $18,725.

2. Office expenses in the amount of $3,700 were paid in cash.

3. Materials and supplies purchased on account during the year were $8,400.

4. A bill totaling $14,525 was received for utilities provided by Washington City€™s utility fund.

5. Cash paid to the federal government for payroll taxes was $23,000.

6. Cash paid to the Utility Fund was $14,500.

7. Accounts payable at year-end totaled $2,950.

8. Materials and supplies used during the year were $8,250.

9. Charges to departments during the fiscal year were as follows:

General Fund...........................................................$57,500

Special Revenue Fund .............................................20,600

10. Unpaid balances at year-end were:

General Fund ............................................................$3,500

Special Revenue Fund ...............................................1,800

11. The depreciation for the year was $6,100.

12. Revenue and expense accounts for the year were closed.

Required

a. Prepare a statement of revenues, expenses, and changes in fund net position for the Information Technology Fund for the current year ended December 31.

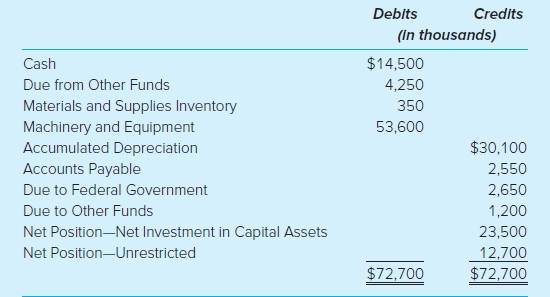

b. Prepare a statement of net position for the Information Technology Fund as of December 31.

c. Prepare a statement of cash flows for the Information Technology Fund for the current year ended December 31.

d. Given the goals of the fund as described above, evaluate the manager of the IT department.

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely