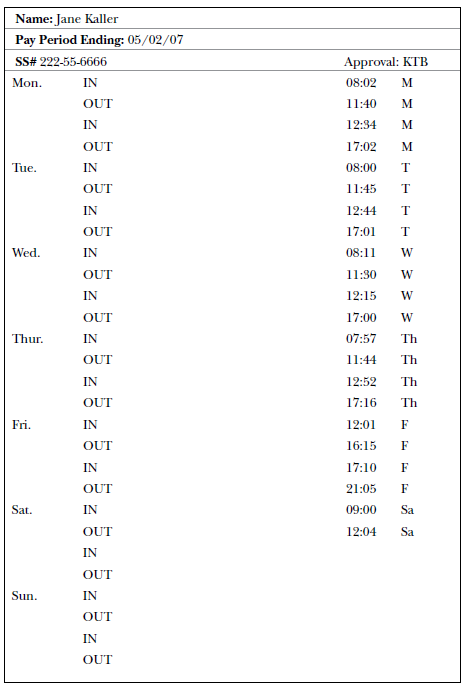

Following is a time sheet completed by an hourly wage earner at Harold, Inc.: Use Microsoft Excel

Question:

Following is a time sheet completed by an hourly wage earner at Harold, Inc.:

Use Microsoft Excel to perform the following tasks:

a. Design an appropriate format for a data entry screen that could be used in the payroll department to enter information from this time sheet in the company?s payroll software program.

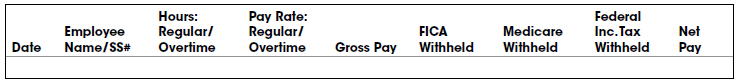

b. Prepare a payroll journal with the column headings shown in the table above. Enter the relevant information from the preceding time sheet onto this journal and calculate gross pay, federal withholdings, and net pay. Use two lines for this employee, and assume that the pay rate is $19.75 per hour, with time?and?a?half for overtime. (Overtime applies to any time worked over 40 hours within one week.) Use the following withholding rates: FICA (Social Security)?6.2 percent of gross pay; Medicare?1.45 percent of gross pay; federal income taxes?20 percent. Assume no additional withholdings.

Step by Step Answer:

Accounting Information Systems Controls and Processes

ISBN: 978-1119329565

3rd edition

Authors: Leslie Turner, Andrea Weickgenannt, Mary Kay Copeland