On 1 January 20X3 Paula Randolph opened a boutique called P.R.'s Boutique. At that time she deposited

Question:

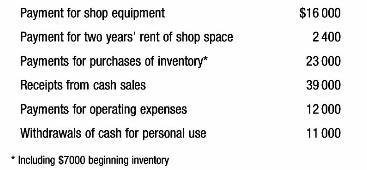

On 1 January 20X3 Paula Randolph opened a boutique called P.R.'s Boutique. At that time she deposited \(\$ 30000\) cash in the business' cheque account. Paula then immediately wrote business cheques to purchase \(\$ 7000\) of inventory and \(\$ 16000\) of shop equipment, and to pay two years' rent in advance for shop space. Paula estimated that the shop equipment would last ten years and then be worthless. During the year the boutique appeared to operate successfully. Paula did not know anything about accounting, although she did keep an accurate business cheque book. The business cheque book showed the following summarised items on 31 December 20X3.

On 31 December 20X3 Paula asks for your assistance. She says, "The ending cash balance in the business cheque book is \(\$ 4600\). Since my initial investment was \(\$ 30000\), the business seems to have had a net loss of \(\$ 25400\). Something must be wrong. I am sure the business did better than that. Please find out what the business' earnings were for \(20 \mathrm{X} 3\), why the cash went down so much during \(20 \mathrm{X} 3\) and what its financial position is at the end of 20X3. Also for what the business sold in 20X3, how does its profit percentage compare with its operating cash intake percentage?'

You agree to help Paula. She tells you that the business used a periodic inventory system during 20X3, that she has just finished "taking inventory", and that the cost of the 20X3 ending inventory is \(\$ 9000\). She has kept copies of invoices made out to customers who purchased merchandise on credit. These uncollected invoices total \(\$ 12000\). Paula also has a file of unpaid invoices from suppliers for purchases of inventory. These unpaid invoices add up to \(\$ 8000\). Just as you begin your calculations, Paula says, 'Oh yes, \(\$ 10000\) of the payments for operating expenses were employees' salaries. I also owe my employees \(\$ 700\) of salaries that they have earned this week.'

Required:

a Prepare a 20X3 income statement, a 20X3 cash flow statement (using the direct method for operating activities) and a 31 December 20X3 balance sheet for P.R.'s Boutique. Include explanations for all amounts shown.

b Answer Paula's question about the comparison of the 'profit percentage' with the 'operating cash intake percentage'.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons