Ryan Landscaping Service had the following account balances at the start of March. Cash $23 710; Accounts

Question:

Ryan Landscaping Service had the following account balances at the start of March. Cash \$23 710; Accounts Receivable \$440; GST Paid \$330; Supplies of Landscaping Materials \(\$ 3200\); Land \(\$ 40000\); Buildings \$82000; Accounts Payable \$123; GST Collected \(\$ 380\) and Mortgage Payable \(\$ 60000\).

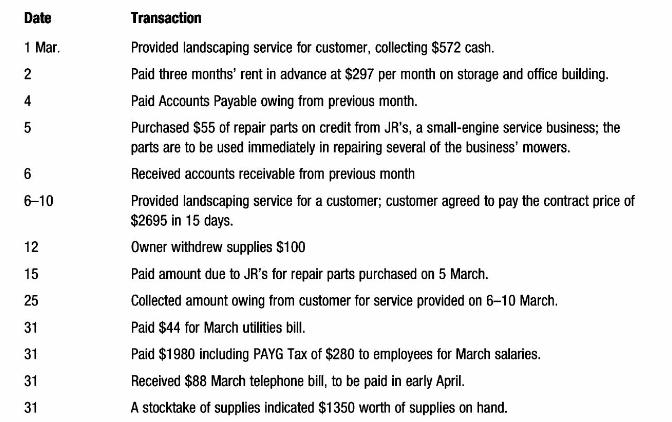

The Ryan Landscaping Service entered into the following transactions during March.

Required:

a Calculate Ryan's capital account balance at 1 March.

b Prepare journal entries to record the preceding transactions.

c Set up the following T-accounts (and account numbers): Cash (101), Accounts Receivable (103) GST Paid (104), Supplies (108); Land (110), Building (112), Accounts Payable (215), GST Payable (220), PAYG Tax Payable (231), Mortgage Payable (221), R. Foster, Capital (301), R. Foster, Drawings (302), Landscaping Services Revenue (401), Repairs Expense (501), Supplies Expense (503), Utilities Expense (502), Telephone Expense (505) and Salaries Expense (507).

d Prepare a Trial Balance at 31 March.

Step by Step Answer:

Accounting Information For Business Decisions

ISBN: 9780170253703

2nd Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh, Geoff Slaughter, Sharelle Simmons