Smartime manufactures three products from a common input in a joint processing operation. Joint processing costs up

Question:

Smartime manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $100 000 annually. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows:

Product A: $40 000 Product B: $80 000 Product C: $30 000.

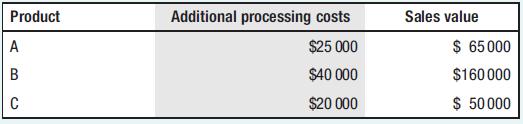

Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are as follows:

- Required:

a Which product or products should be sold at the split-off point, and which product or products should be processed further? Show workings.

b What comments would you make with respect to joint costs and their allocation and the decision to process further?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Information For Business Decisions Accounting

ISBN: 9780170446242

4th Edition

Authors: Billie Cunningham, Loren A. Nikolai, John Bazley, Marie Kavanagh

Question Posted: