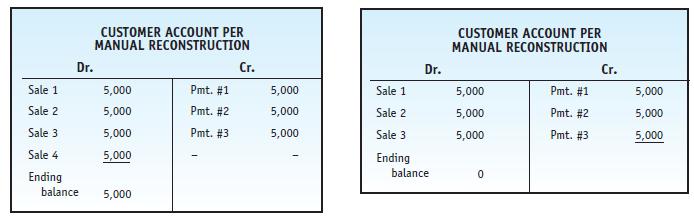

When an adding machine tape of the individual account balances was run, the individual balances did not

Question:

When an adding machine tape of the individual account balances was run, the individual balances did not add up to the total at the bottom of the report.

Susan concluded that the accounts receivable program was not running properly. The auditor’s recommendation was that an effort be made to find out why the accounts receivable control account and the summary totals per the accounts receivable subsidiary ledger were not in agreement and why there were problems with the accounts receivable listing.

Because the accounts receivable subsidiary and accounts receivable control account in the general ledger had been in agreement at the end of April, the effort should begin with the April ending balances for each customer by manually updating all of the accounts.

The manually adjusted May 30 balances should then be compared with the computer-

generated balances and any differences investigated.

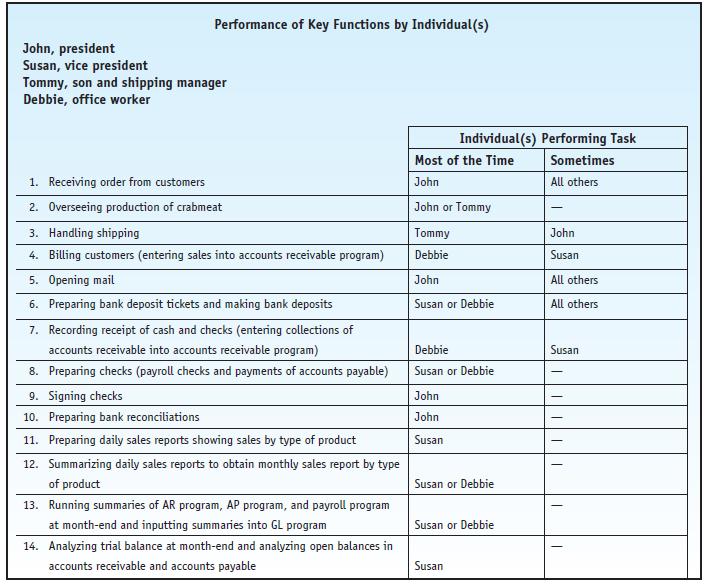

After doing this, Susan and John found several differences. The largest difference was the following: Although they found the manual sales invoice for Sale 2, Susan and John concluded (based on the computer records)

that Sale 2 did not take place. The auditor was not sure and recommended that they call this customer and ask him the following:

1.. Did he receive this order?

2.. Did he receive an invoice for it?

3.. Did he pay for the order?

4.. If so, did he have a copy of his canceled check?

Although John felt that this would be a waste of time, he called the customer. He received an affirmative answer to all of his questions. In addition, he found that the customer’s check was stamped on the back with an address stamp giving only the company’s name and city rather than the usual “for deposit only”

company stamp. When questioned, Debbie said that she sometimes used this stamp.

Right after this question, Debbie, who was sitting nearby at the computer, called Susan to the computer and showed her the customer’s account. She said that the payment for $5,000 was in fact recorded in the customer’s account. The payments were listed on the computer screen like this:

Amount Date of Payment

$5,000 May 3

$5,000 May 17

$5,000 May 23

$5,000 May 10 The auditor questioned the order of the payments—

why was a check supposedly received on May 10 entered in the computer after checks received on May 17 and 23? About 30 seconds later, the computer malfunctioned and the accounts receivable file was lost.

Every effort to retrieve the file gave the message “file not found.”

About five minutes later, Debbie presented Susan with a copy of a bank deposit ticket dated May 10 with several checks listed on it, including the check that the customer said had been sent to the company. The deposit ticket, however, was not stamped by the bank (which would have verified that the deposit had been received by the bank) and did not add up to the total at the bottom of the ticket (it was off by 20 cents).

At this point, being very suspicious, the auditor gathered all of the documents he could and left the company to work on the problem at home, away from any potential suspects. He received a call from Susan about four hours later saying that she felt much better. She and Debbie had gone to RadioShack (the maker of their computer program) and RadioShack had confirmed Susan’s conclusion that the computer program was malfunctioning. She and Debbie were planning to work all weekend reentering transactions into the computer. She said that everything looked fine and not to waste more time and expense working on the problem.

The auditor felt differently. How do you feel?

Required:

a. If you were asked to help this company, could you conclude from the evidence presented that embezzlement took place?

What would you do next?

b. Who do you think was the embezzler?

c. How was the embezzlement accomplished?

d. What improvements would you recommend in internal control to prevent this from happening again? In answering this question, try to identify at least one suggestion from each of the six classes of internal control activities discussed in this chapter (in the Control Activities section): transaction authorization, segregation of duties, supervision, accounting records, access control, and independent verification.

e. Would the fact that the records were maintained on a microcomputer aid in this embezzlement scheme?

Step by Step Answer: