The Breakaway Holiday Company has overheads totalling 800,000. Until recently it had applied its overheads on a

Question:

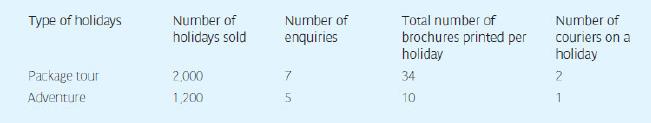

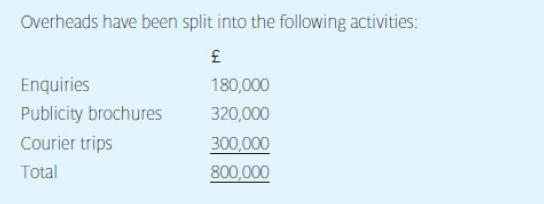

The Breakaway Holiday Company has overheads totalling £800,000. Until recently it had applied its overheads on a traditional volume basis, based on the number of holidays sold. It sells two major products, package tours and adventure holidays.

Required:

a Calculate to the nearest £, the overhead cost of a holiday based on the traditional volume-based method.

b Recalculate the overhead costs of both types of holiday, using an activity-based costing approach, showing how the costs differ from (a) above.

c Indicate what advantages and possible disadvantages an activitybased costing approach can bring to an organization.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: