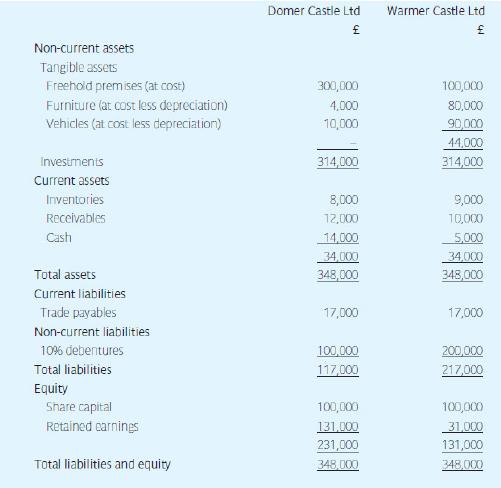

You are given the following simplified statements of financial position of two very similar companies, Domer Castle

Question:

You are given the following simplified statements of financial position of two very similar companies, Domer Castle Company and Warmer Castle Company as at 31 December year 1.

During year 1 the operating profit (earnings before interest and taxation) of the Domer Castle Company amounted to £31,000. The operating profit of the Warmer Castle Company amounted to £32,000.

Which of the two companies appears to be financially weakest, and why? You should calculate the current ratio, the liquidity ratio, the capital gearing ratio and the number of times interest is covered by operating profit.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: