Juliet opened a coffee shop in Paris two years ago. The business has grown steadily, and the

Question:

Juliet opened a coffee shop in Paris two years ago. The business has grown steadily, and the shop is frequently so full that some potential customers have to be turned away. She is considering three possible ways of expanding the business:

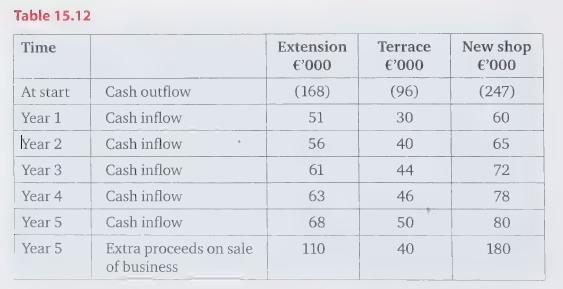

She has researched the various options and has come up with the estimates shown in Table 15.12 for the next five years. Whichever option is chosen, Juliet plans to sell the entire business in five years’ time.

Juliet would require a return of at least 12% from any project undertaken.

Assume that the cash flows arise at the end of each year and ignore cash flows arising after this five year period.

REQUIRED:

a) Calculate the payback period for each of the three options.

b) Calculate the accounting rate of return for each of the options if the average investment required for each option is as follows:

Extension €140,000 Terrace €/0,000 New shop — €215,000 Depreciation would be charged on the straight-line basis on all of the projects.

c) Calculate the net present value for each of the options.

d) Interpret your findings for parts (a) to (0).

e) If Juliet would like to proceed with no more than one of the projects, advise her as to which of the options, if any, she should choose based on your appraisals. Discuss other factors that Juliet should take into account in her decision-making.

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles