Kim has prepared the information in Table 9.1 so that Sam can consider whether to obtain external

Question:

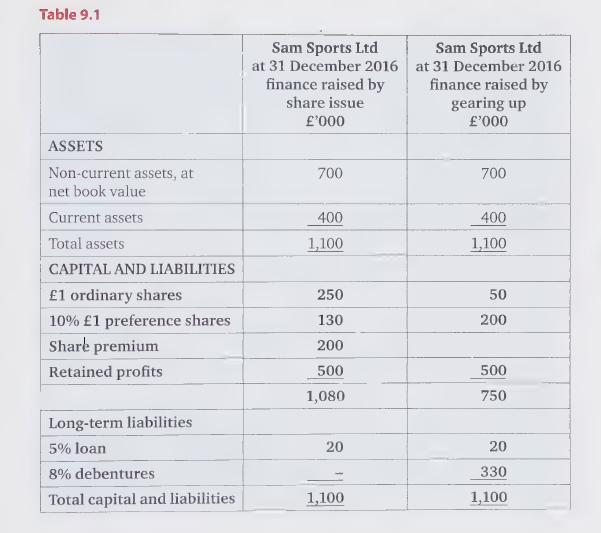

Kim has prepared the information in Table 9.1 so that Sam can consider whether to obtain external funding by issuing ordinary shares or by issuing debt. He has prepared alternative statements of financial positions for each option:

a) Calculate the gearing proportion for the alternative funding methods.

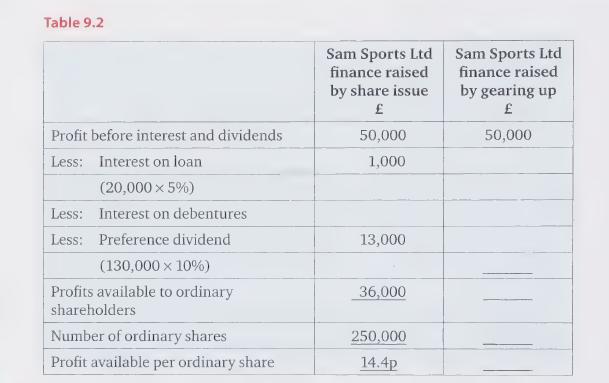

b) Calculate the profit available per ordinary share if the finance is raised by gearing and if profits before interest and dividends amount to £50,000. The workings have been done for the share issue option (see Table 9.2).

c) If profits are likely to be less than £50,000, advise Sam as to whether he should fund the expansion by shares or by loans.

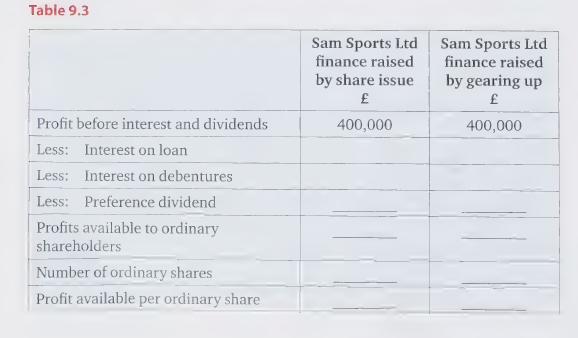

d) If profits for both scenarios are predicted to rise rapidly to £400,000 per annum in two years’ time, calculate the profit available per ordinary share then (see Table 9.3). Note that there would be no new share or debenture issues in the intervening period.

e) Based on the calculations in Table 9.3, would you advise Sam to obtain external funding from shares or from loans?

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles