Sam sets about planning the cash receipts and payments for the next three months, taking into account

Question:

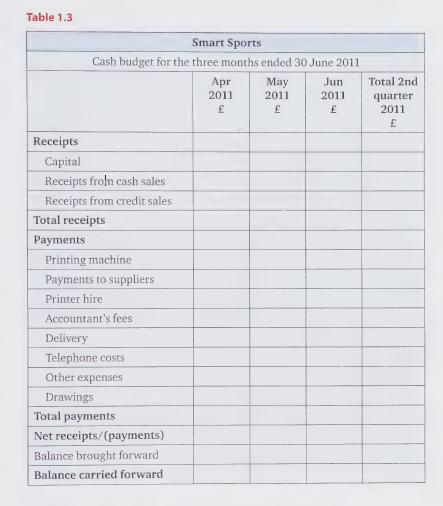

Sam sets about planning the cash receipts and payments for the next three months, taking into account the different timings that will arise from sales and purchases being made on credit.

a) Sam expects to sell the following hockey kits April £2,400 to Rovers May £4,000 to Tigers June £5,000 to Panther Cubs.

He has agreed that Rovers and Tigers will pay for their kits at the end of the month following the sale, but the Panther Cubs will pay cash on receipt of the kits.

b) Sam expects to make the following purchases, still payable in the month in which he takes delivery:

April £1,500 for Rover’s kits May £2,000 for Tiger’s kits June £4,000 for Panther Cub’s kits.

c) Sam intends to buy a second-hand printing machine for £5,500 in May so that he can save printing costs in the second half of the year. He will continue to pay £100 per month for April, May, and June for the hire of the old machine.

d) Kim will receive the same fee of £125 each month, and Sam will continue to pay the telephone costs as for the first quarter. He expects delivery costs to increase to £100 per month from May and other expenses to rise by £100 per month from May.

e) Sam will need to withdraw £600 per month to cover his personal expenses.

Using Table 1.3, prepare Sam’s cash budget for his second three months of trading from April to June 2011. Using this information, does Sam need to ask his mother, Betty, for a loan or should he arrange an overdraft? If so, what size loan or overdraft should he request, and by when does he need it?

Step by Step Answer:

Accounting A Smart Approach

ISBN: 9780199587414

1st Edition

Authors: Mary Carey, Jane Towers Clark, Cathy Knowles