Question:

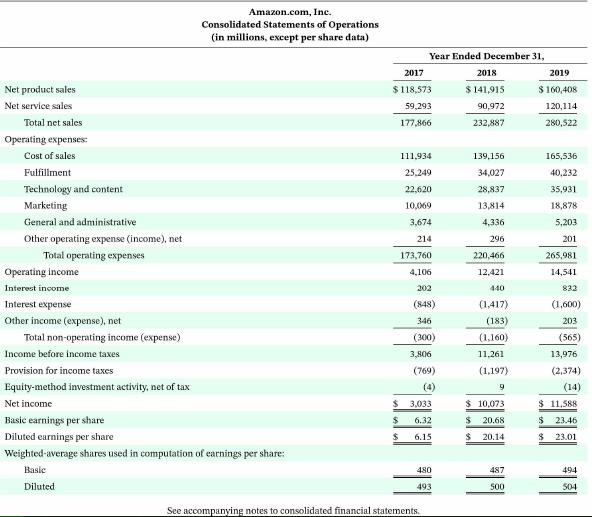

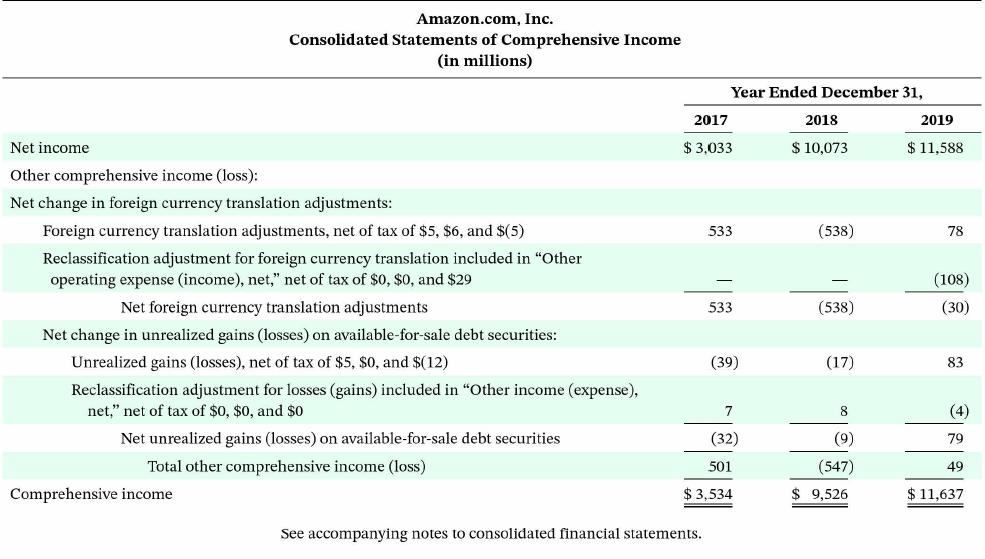

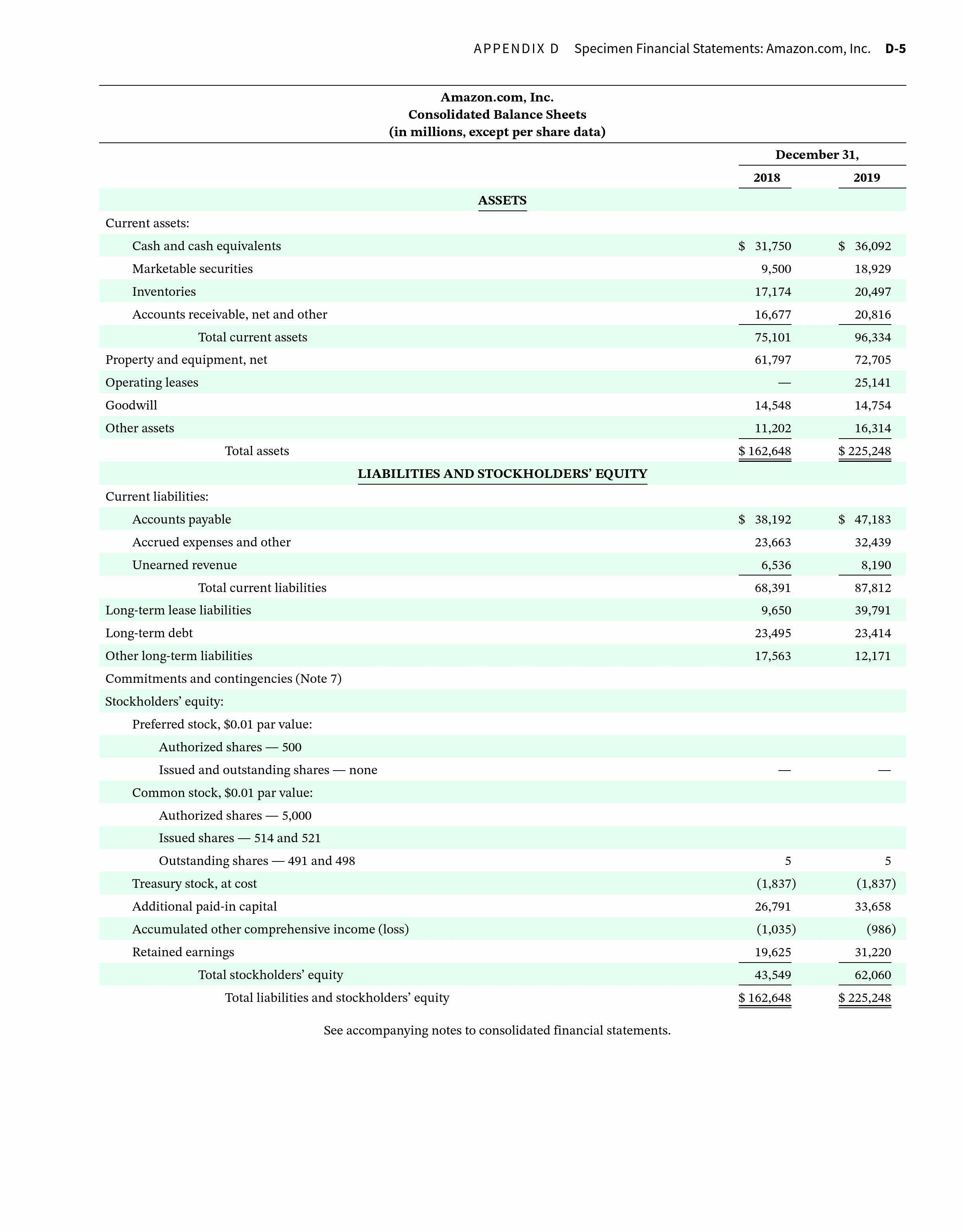

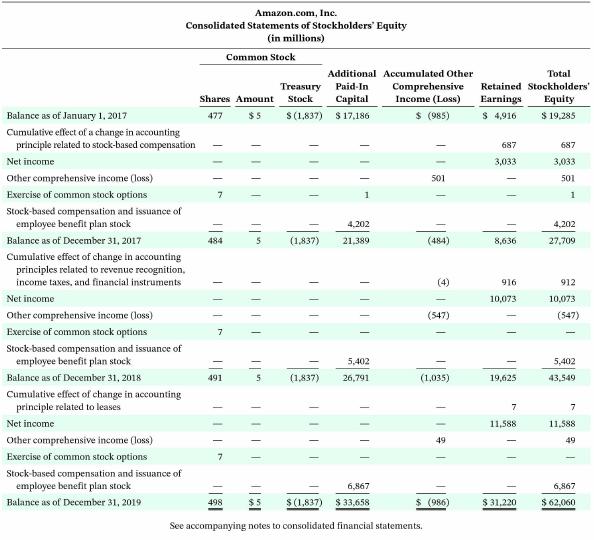

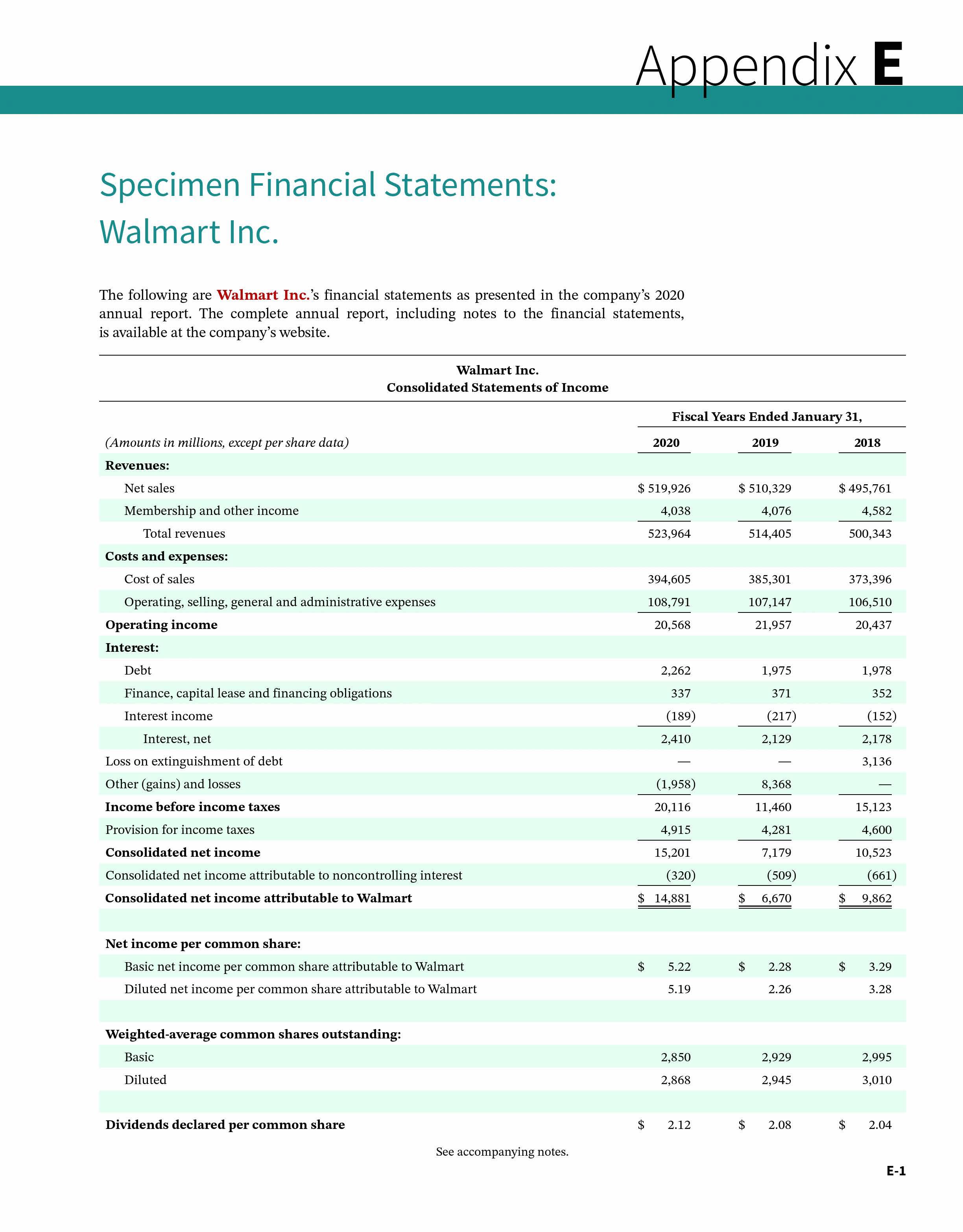

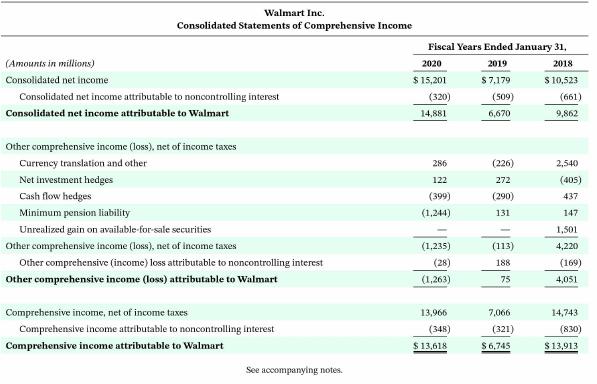

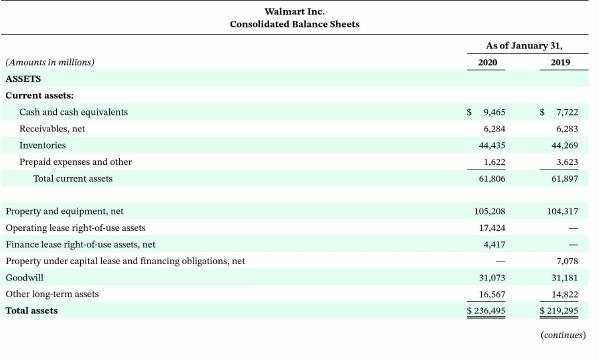

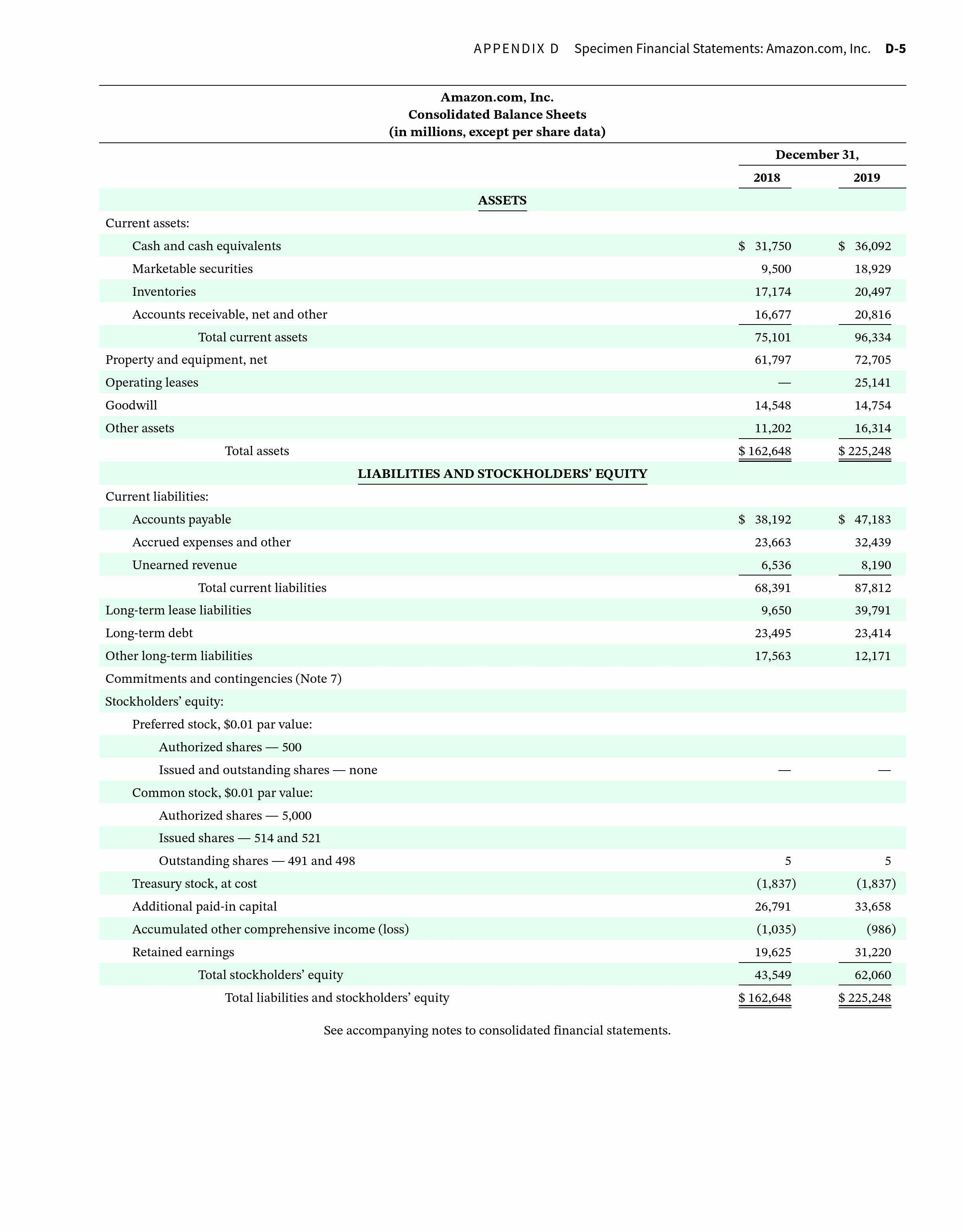

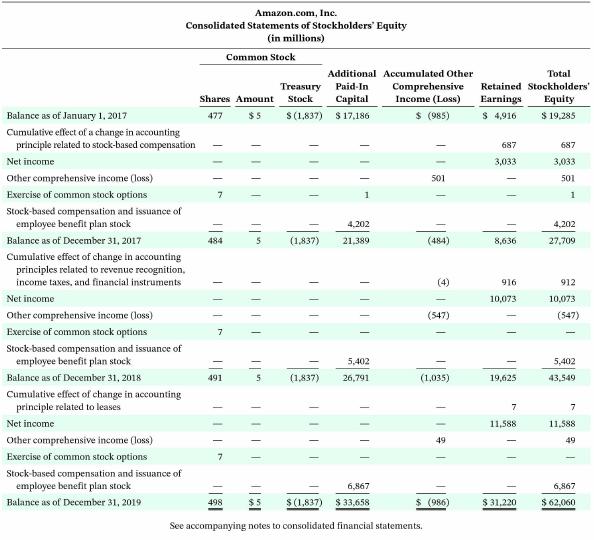

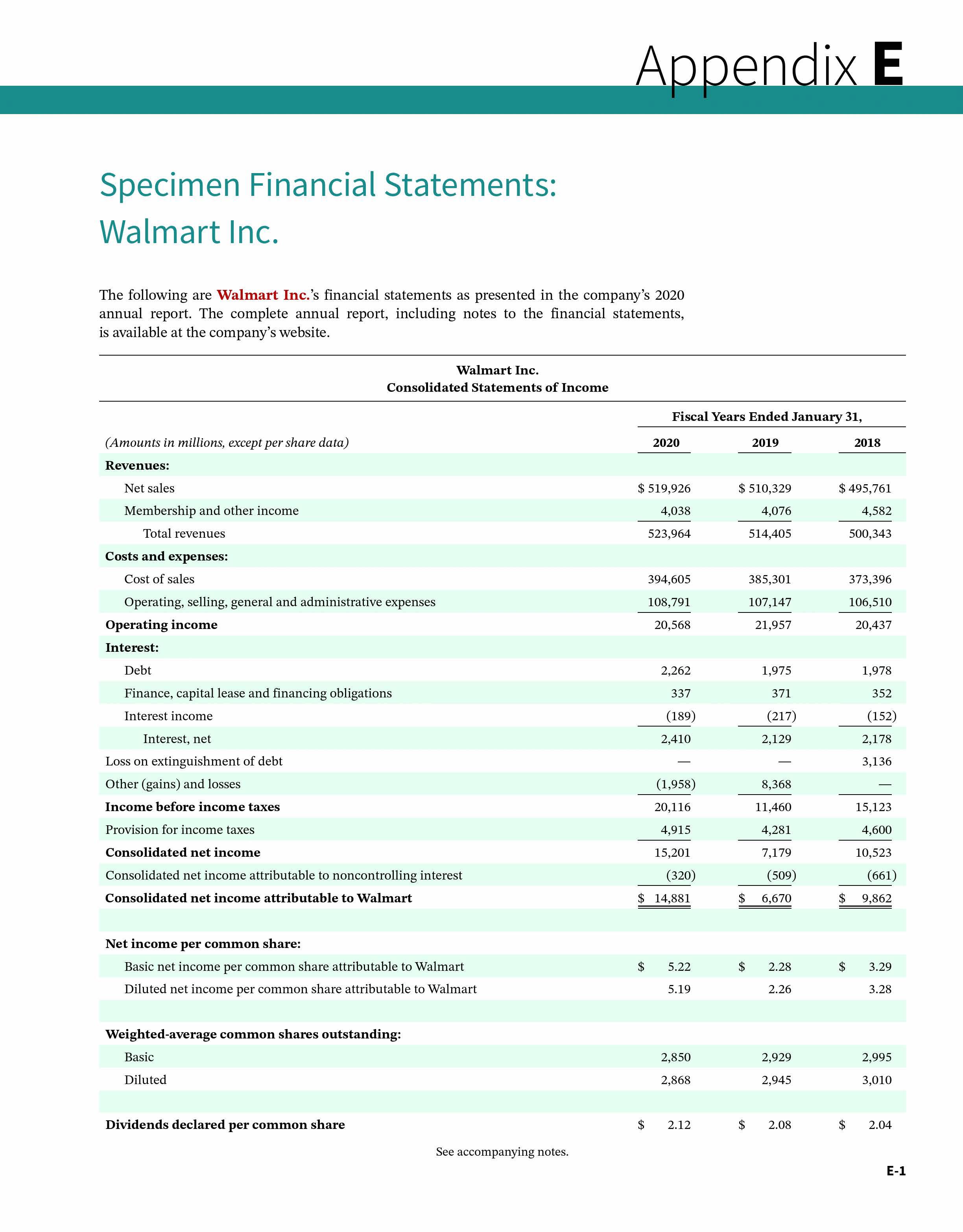

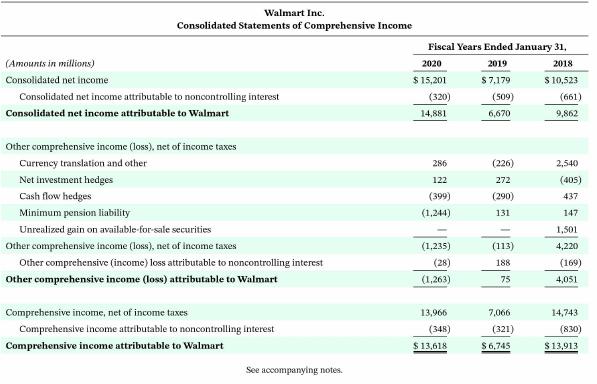

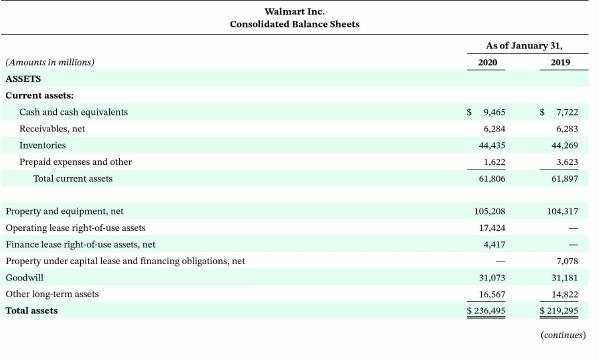

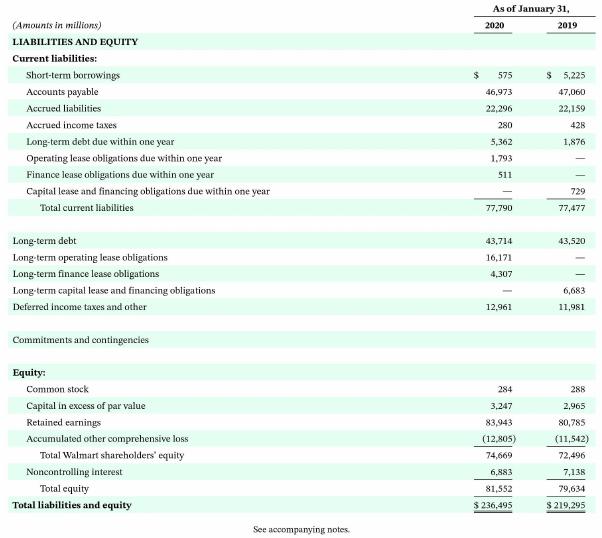

Amazon.com, Inc. vs. Walmart Inc. CTll.3 Amazon.com Inc.'s financial statements are presented in Appendix D. Financial statements of Walmart Inc. are presented in Appendix E. The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website.

Instructions

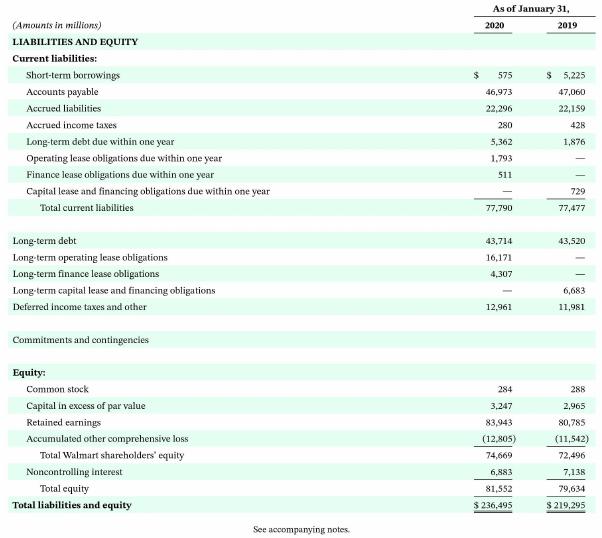

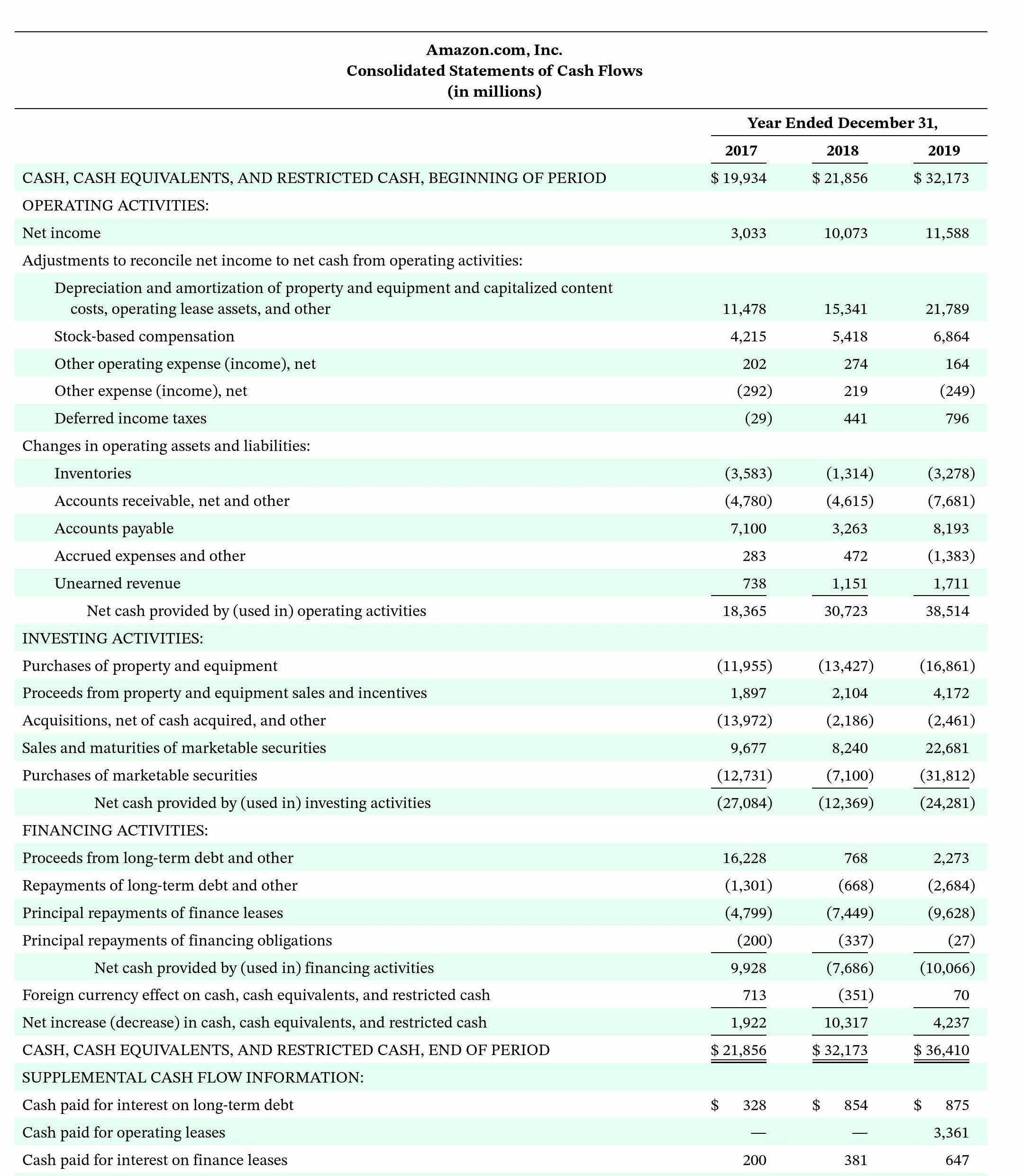

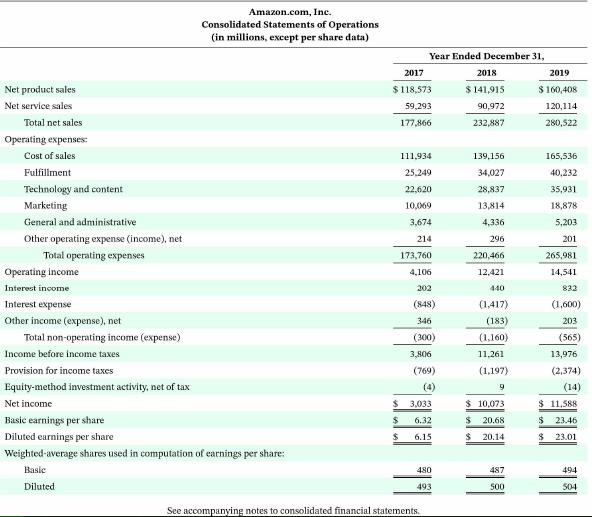

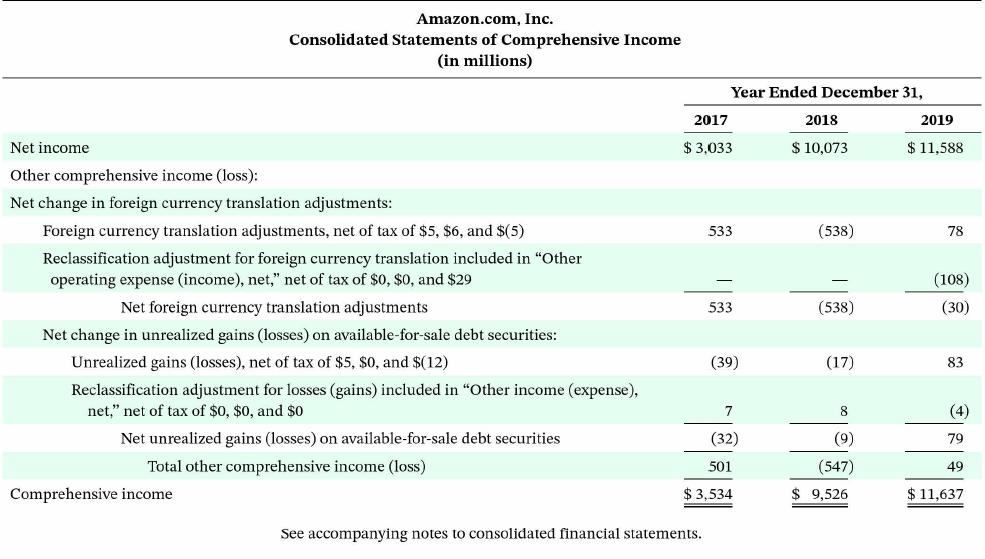

a. At December 31, 2019, what was Amazon's largest current liability account? What were its total current liabilities? At January 31, 2020, what was Walmart's largest current liability account? What were its total current liabilities?

b. Based on information in these financial statements, compute the following 2019 values for Amazon and 2020 values for Walmart:

1. Working capital.

2. Current ratio.

c. What conclusions concerning the relative liquidity of these companies can be drawn from these data?

Transcribed Image Text:

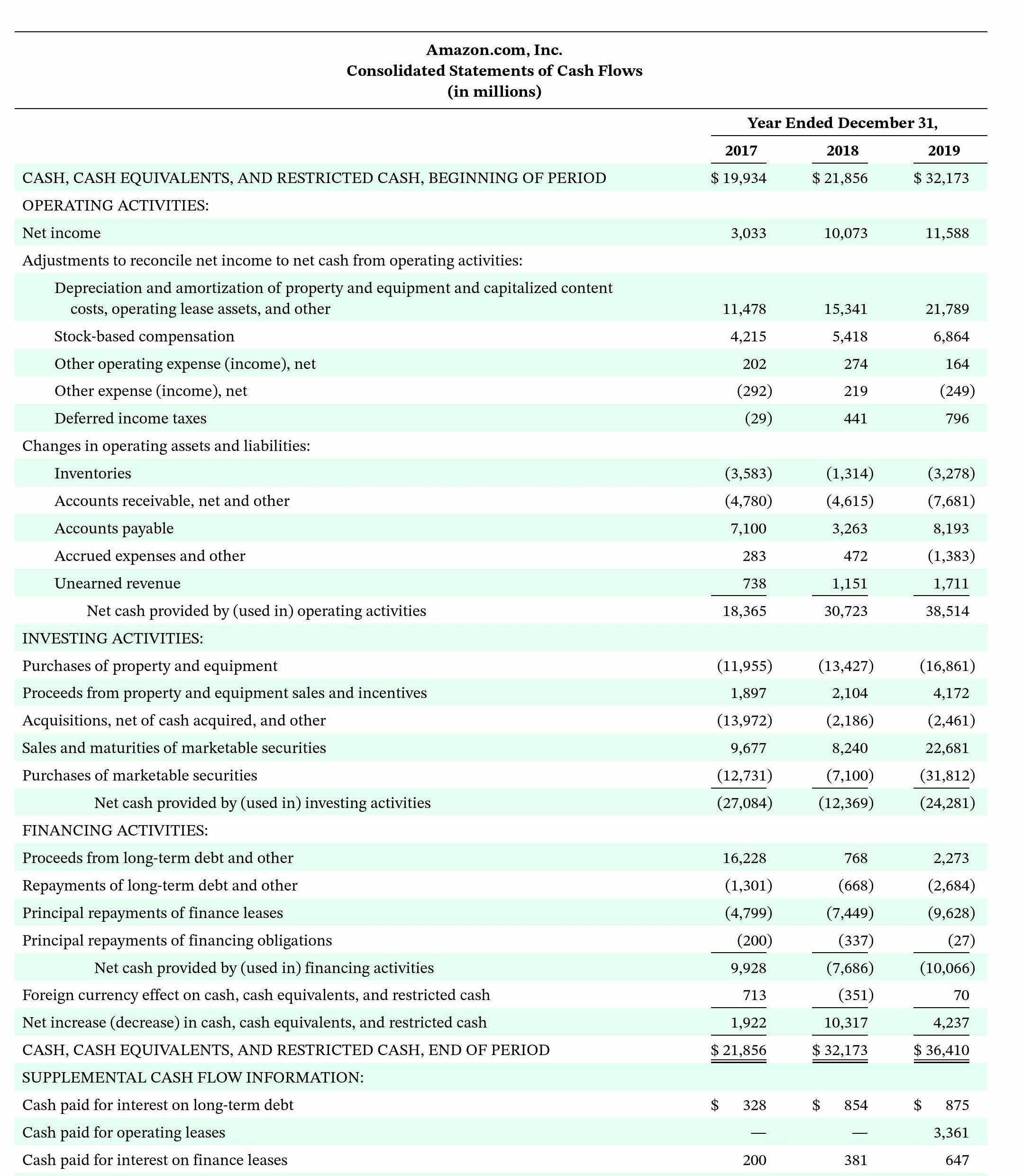

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Amazon.com, Inc. Consolidated Statements of Cash Flows (in millions) Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for operating leases Cash paid for interest on finance leases Year Ended December 31, 2017 $ 19,934 3,033 $ 11,478 4,215 202 (292) (29) (3,583) (4,780) 7,100 283 738 18,365 (11,955) 1,897 (13,972) 9,677 (12,731) (27,084) 16,228 (1,301) (4,799) (200) 9,928 713 1,922 $ 21,856 328 200 2018 $ 21,856 10,073 15,341 5,418 274 219 441 (1,314) (4,615) 3,263 472 1,151 30,723 (13,427) 2,104 (2,186) 8,240 (7,100) (12,369) 768 (668) (7,449) (337) (7,686) (351) 10,317 $ 32,173 854 381 2019 $ 32,173 11,588 21,789 6,864 164 (249) 796 $ (3,278) (7,681) 8,193 (1,383) 1,711 38,514 (16,861) 4,172 (2,461) 22,681 (31,812) (24,281) 2,273 (2,684) (9,628) (27) (10,066) 70 4,237 $36,410 875 3,361 647