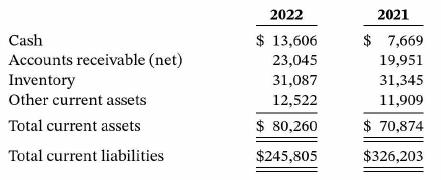

Suppose these selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands).

Question:

Suppose these selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands).

Compute the current ratio for each year and comment on your results.

Cash Accounts receivable (net) Inventory Other current assets Total current assets Total current liabilities 2022 $ 13,606 23,045 31,087 12,522 $ 80,260 $245,805 2021 $ 7,669 19,951 31,345 11,909 $ 70,874 $326,203

Step by Step Answer:

The current ratio is calculated by dividing current assets by current liabilities For ...View the full answer

Accounting Principles

ISBN: 9781119707110

14th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Jill E. Mitchell

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

These selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands). Compute the current ratio for each year and comment on your results. 2009 2008 $ 13,606 23,045...

-

These selected condensed data are taken from recent balance sheets of Bob Evans Farms (in thousands). Compute the current ratio for each year and comment on yourresults. 2007 2006 Cash Accounts...

-

These selected condensed data are taken from a recent balance sheet of Bob Evans Farms (in millions of dollars). Cash ............. $ 29.3 Accounts receivable .......... 20.5 Inventory ...............

-

Briefly explain the differences between copyrights and patents.

-

When an investor buys some shares of a corporation at one price and later buys more shares of the same corporation at another price, how does the investor determine the cost for tax purposes when...

-

To what factors would you attribute the large difference in the specific energies within each group of materials shown in Table 8.3?

-

Outline and explain the four key stages in the industry lifecycle. LO.1

-

Consider the brief description of Targets stakeholder relationships and combine that information with your experience shopping in a Target store. How might Targets stakeholders (in particular,...

-

What are the PMI requirements for Freddie Mac loan compared to FHA loans (10 points)?

-

Refer to DCdesserts.coms activity-based flexible budget in Exhibit 1111. Suppose that the companys activity in June is described as follows: In Exhibit 1111 Process...

-

The following data are taken from the financial statements of Colby Company. Compute for each year (a) The accounts receivable turnover (b) The average collection period. What conclusions about the...

-

Horizontal analysis (trend analysis) percentages for Phoenix Company's sales revenue, cost of goods sold, and expenses are listed here. Explain whether Phoenix's net income increased, decreased, or...

-

Consider a material that is gray, but directionally selective with \(\alpha_{\theta}(\theta, \phi)=0.8(1-\cos \phi)\). Determine the hemispherical absorptivity \(\alpha\) when collimated flux...

-

Absorption linewidth for an absorbing atomic transition. Consider the curves of power transmission T(w) = exp[-2am(w)L] through an atomic medium with a lorentzian resonant transition, plotted versus...

-

EXAMPLE 05.04 Z Write the force and the couple in the vector form (with rectangular/Cartesian components). Use C = 180 N-m and P = 500 N O INDIVIDUAL Submission (IS12) D x 400 mm B C 300 mm A 400 mm...

-

1.XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data are available: Budgeted annual overhead for...

-

OP Technologies Manufacturing manufactures small parts and uses an activity-based costing system. Activity Materials Assembling Packaging Est. Indirect Activity Costs $65,000 $242,000 $90,000...

-

3. Solve Example 3.7 (Bergman, Lavine, Incropera, and DeWitt, 6th Ed., pp. 129-132, or 7th Ed., pp. 145-149, or 8th Ed., pp. 134-138), but use the finite difference method. T T = 30C Insulation-...

-

Find vectors parallel to v of the given length. with P(3, 4, 0) and Q(2, 3, 1); length = 3 PO

-

On July 1, 2011, Flashlight Corporation sold equipment it had recently purchased to an unaffiliated company for $480,000. The equipment had a book value on Flashlights books of $390,000 and a...

-

Presented below are three different lease transactions in which Ortiz Enterprises engaged in 2010.Assume that all lease transactions start on January 1, 2010. In no case does Ortiz receive title to...

-

On July 1, 2010, Wheeler Satellites issued $4,500,000 face value, 9%, 10-year bonds at $4,219,600.This price resulted in an effective-interest rate of 10% on the bonds. Wheeler uses the...

-

On July 1, 2010, Remington Chemical Company issued $4,000,000 face value, 10%,10-year bonds at $4,543,627.This price resulted in an 8% effective-interest rate on the bonds. Remington uses the...

-

Jennifer purchased a home for $1,000,000 in 2016. She paid $200,000 cash and borrowed the remaining $800,000. This is Jennifer's only residence. Assume that in year 2024, when the home had...

-

business plan describing company with strengths and weaknesses. Any gaps in plan. Recommendations for improvement of the plan.

-

You wish to buy a car today for $35,000. You plan to put 10% down and finance the rest at 5.20% p.a. for six years. You will make equal monthly payments of $_______.

Study smarter with the SolutionInn App