At the end of its first year of operations, on December 31, 2024, LBG Companys accounts show

Question:

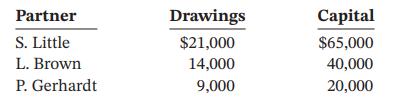

At the end of its first year of operations, on December 31, 2024, LBG Company’s accounts show the following:

The capital balance represents each partner’s initial capital investment on January 1, 2024. No closing entries have been recorded for profit (loss) as yet.

Instructions

a. Journalize the entry to record the division of profit for the year ended December 31, 2024, under each of the following independent assumptions:

1. Profit is $30,000. Income is shared 6:3:1.

2. Profit is $55,000. Little, Brown, and Gerhardt are given salary allowances of $5,000, $25,000, and $10,000, respectively. The remainder is shared equally.

3. Profit is $25,000. Each partner is allowed interest of 7% on beginning capital balances. Brown and Gerhardt are given salary allowances of $15,000 and $20,000, respectively. The remainder is shared 3:2:1.

b. Prepare a statement of partners’ equity for the year under assumption 2 in part (a) above.

Explain why partnerships such as LBG Company include a salary allowance in their profit- and loss-sharing arrangements.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak