Nordstrom, Inc. has select stores across Canada that compete against Hudsons Bay Company and other higher-end retailers.

Question:

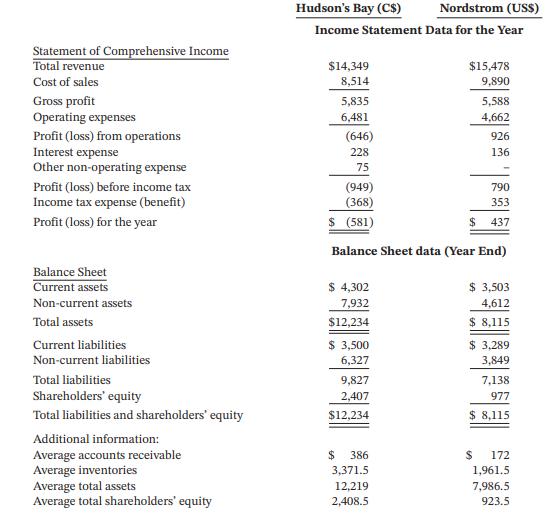

Nordstrom, Inc. has select stores across Canada that compete against Hudson’s Bay Company and other higher-end retailers. Selected hypothetical financial data (in millions) for the two companies’ global operations are presented here.

Instructions

a. For each company, calculate the following ratios:

1. Current ratio

2. Receivables turnover

3. Inventory turnover

4. Operating cycle

5. Debt to total assets

6. Interest coverage

7. Gross profit margin

8. Profit margin

9. Asset turnover

10. Return on assets

11. Return on equity

b. Compare the liquidity, solvency, and profitability of the two companies.

If the entities presented other comprehensive loss, should it be factored into your analysis above?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak