On March 31, Babb Company had the following payroll liability accounts in its ledger: In April, the

Question:

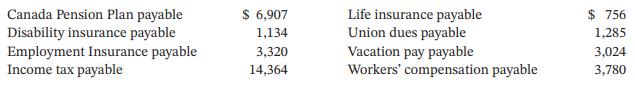

On March 31, Babb Company had the following payroll liability accounts in its ledger:

In April, the following transactions occurred:

Apr. 4 Sent a cheque to the union treasurer for union dues.

7 Sent a cheque to the insurance company for the disability and life insurance.

13 Issued a cheque to the Receiver General for the amounts due for CPP, EI, and income tax.

20 Paid the amount due to the workers’ compensation plan.

28 Completed the monthly payroll register, which shows gross salaries $83,160, CPP withheld $4,532, EI withheld $1,314, income tax withheld $15,800, union dues withheld $1,414, and long-term disability insurance premiums $1,247.

28 Prepared payroll cheques for the April net pay and distributed the cheques to the employees.

28 Recorded an adjusting journal entry to record April employee benefits for CPP, EI, workers’ compensation at 5% of gross pay, vacation pay at 4% of gross pay, and life insurance at 1% of gross pay.

Instructions

a. Journalize the April transactions and adjustments.

b. Calculate the balances in each of the payroll liability accounts at April 30.

Why do employers need an employee earnings record for each employee as well as a payroll register?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak