The following information is provided for Charlies Chocolate Corporation, which reports under ASPE: Additional information: 1. Profit

Question:

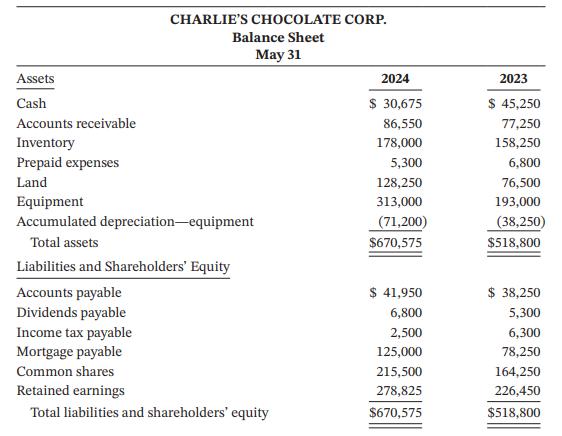

The following information is provided for Charlie’s Chocolate Corporation, which reports under ASPE:

Additional information:

1. Profit for 2024 was $113,625.

2. Common shares were issued for $51,250.

3. Land with a cost of $51,250 was sold at a loss of $19,300.

4. Purchased land with a cost of $103,000 with a $56,250 down payment and financed the remainder with a mortgage note payable.

5. No equipment was sold during 2024.

6. Net sales for the year were $673,600.

7. Cost of goods sold for the year was $399,800.

8. Operating costs, including depreciation expense, were $97,700.

9. Interest expense was $5,300.

10. Income tax expense was $37,875.

11. Accounts payable is used for merchandise purchases.

Instructions

Prepare a cash flow statement for the year using the direct method. Taking It Further Indicate what transactions might be classified differently if the company were reporting under IFRS instead of ASPE.

Indicate what transactions might be classified differently if the company were reporting under IFRS instead of ASPE

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak