The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended

Question:

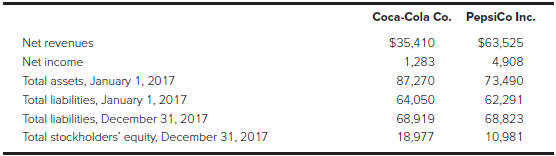

The annual reports of the Coca-Cola Co. and PepsiCo Inc. indicate the following for the year ended December 31, 2017 (amounts in millions):

Required:

a. Calculate ROI and ROE for each company for 2017. (Hint: You will need to calculate some of the numbers used in the denominator of these ratios.)

b. Based on the results of your ROI and ROE analysis in part a, do you believe that either firm uses financial leverage more effectively than the other? Explain your answer. (Hint: Compare the percentage differences between ROI and ROE for each firm. Is there a significant difference that would suggest that one firm uses leverage more effectively than the other?)

c. Calculate the debt ratio and debt/equity ratio for each firm at the end of 2017.

d. Compare the results of your analysis in part c to your expectations concerning the relative use of financial leverage in part b. Do the debt and debt/equity ratios calculated in part c make sense relative to your expectations? Explain your answer.

Step by Step Answer:

Accounting What the Numbers Mean

ISBN: 978-1260565492

12th edition

Authors: David Marshall, Wayne McManus, Daniel Viele