Calculate cash available upon liquidation of business Kimber Co. is in the process of liquidating and going

Question:

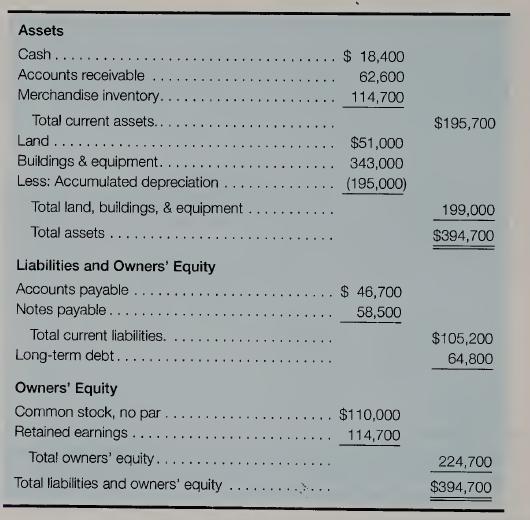

Calculate cash available upon liquidation of business Kimber Co. is in the process of liquidating and going out of business. The firm’s accountant has provided the following balance sheet and additional information:

It is estimated that all but 12% of the accounts receivable can be collected, and that the merchandise inventory can be disposed of in a liquidation sale for 85% of its cost. Buildings and equipment can be sold at $40,000 above book value (the difference be¬ tween original cost and accumulated depreciation shown on the balance sheet), and the land can be sold at its current appraisal value of $65,000. In addition to the liabilities included in the balance sheet, $2,400 is owed to employees for their work since the last pay period, and interest of $5,250 has accrued on notes payable and long-term debt.

Required:

a. Calculate the amount of cash that will be available to the stockholders if the accounts receivable are collected, the other assets are sold as described, and all liabilities and other claims are paid in full.

b. Briefly explain why the amount of cash available to stockholders (computed in part

a) is different than the amount of total owners’ equity shown in the balance sheet.

Step by Step Answer:

Accounting What The Numbers Mean

ISBN: 9780073379418

8th Edition

Authors: David Marshall, Wayne McManus, Daniel Viele