Franklin Co. has experienced gross profit ratios for 2022, 2021, and 2020 of 41%, 38%, and 40%,

Question:

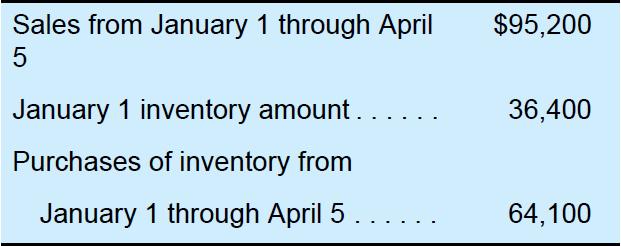

Franklin Co. has experienced gross profit ratios for 2022, 2021, and 2020 of 41%, 38%, and 40%, respectively. On April 6, 2023, the firm’s plant and all its inventory were destroyed by a tornado. Accounting records for 2023, which were available because they were stored in a protected vault, showed the following:

Required:

Calculate the amount of the insurance claim to be filed for the inventory destroyed in the tornado.

Transcribed Image Text:

Sales from January 1 through April 5 January 1 inventory amount. Purchases of inventory from January 1 through April 5 . . . . . $95,200 36,400 64,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Calculate ending inventory in the cost of goods sold model for the high 41 an...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Franklin Co. has experienced gross profit ratios for 2010, 2009, and 2008 of 33%, 30%, and 31%, respectively. On April 3, 2011, the firms plant and all of its inventory were destroyed by a tornado....

-

Franklin Co. has experienced gross profit ratios for 2019, 2018, and 2017 of 33%, 30%, and 31%, respectively. On April 3, 2020, the firms plant and all its inventory were destroyed by a tornado....

-

The inventory of Dons Grocery was destroyed by a tornado on October 6 of the current year. Fortunately, some of the accounting records were at the home of one of the owners and were not damaged. The...

-

X-Tech Inc. produces specialized bolts for the aerospace industry. The operating cost of producing a single bolt is $2. The company currently sells the bolts for $6/unit. Each time the company...

-

Repeat the requirements of P8- 8 assuming Wayne Computer Consultants uses the completed- contract method to report its long- term contracts. In p8-8 Required a. Compute the gross profit and revenue...

-

One byte of memory consists of ____________ bits.

-

Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below. An accounting assistant has prepared the detailed manufacturing...

-

A particle of mass 1.18 kg is attached between two identical springs on a horizontal frictionless tabletop. The springs have force constant k and each is initially unstressed. (a) If the particle is...

-

CAS 550 Related parties What is the impact on the audit overall of discovering a previously unknown related party in the execution phase

-

Anne Aylor, Inc. (Anne Aylor) is a leading national specialty retailer of high-quality womens apparel, shoes, and accessories sold primarily under the Anne Aylor brand name. Anne Aylor is a highly...

-

On April 8, 2022, a flood destroyed the warehouse of Marmaron Distributing Co. From the waterlogged records of the company, management was able to determine that the firms gross profit ratio had...

-

The following information is available from the accounting records of Spenser Co. for the year ended December 31, 2022: Required: a. Calculate the operating income for Spenser Co. for the year ended...

-

Draw a figure using a small number of data points to illustrate the argument that you could have a negative relationship between weight and height within each gender and yet still have a positive...

-

Absorption linewidth for an absorbing atomic transition. Consider the curves of power transmission T(w) = exp[-2am(w)L] through an atomic medium with a lorentzian resonant transition, plotted versus...

-

EXAMPLE 05.04 Z Write the force and the couple in the vector form (with rectangular/Cartesian components). Use C = 180 N-m and P = 500 N O INDIVIDUAL Submission (IS12) D x 400 mm B C 300 mm A 400 mm...

-

1.XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data are available: Budgeted annual overhead for...

-

OP Technologies Manufacturing manufactures small parts and uses an activity-based costing system. Activity Materials Assembling Packaging Est. Indirect Activity Costs $65,000 $242,000 $90,000...

-

3. Solve Example 3.7 (Bergman, Lavine, Incropera, and DeWitt, 6th Ed., pp. 129-132, or 7th Ed., pp. 145-149, or 8th Ed., pp. 134-138), but use the finite difference method. T T = 30C Insulation-...

-

Is it possible for the final temperature of the objects discussed in question 8 to be greater than the initial temperatures of both objects? Explain. Data from question 8 How much heat must be added...

-

1. As a general strategy, would you recommend that Carl take an aggressive approach to capacity expansion or more of a wait-and-see approach? 2. Should Carl go with the option for one facility that...

-

Jessie Co. issued $2 million face amount of 7%. 20-year bonds on April 1, 2016. The bonds pay interest on an annual basis on March 31 each year. Required: a. Assume that market interest rates were...

-

Alexi Co, issued $25 million face amount of 6%, 10-year bonds on June 1. 2016. The bonds pay interest on an annual basis on May 31 each year. Required: a. Assume that the market interest rates were...

-

For the payroll period ended on June 25, 2016, gross pay was $28.600, net pay was $20,400. FICA tax with holdings were $2,000, income tax with holdings were $5.000, and medical insurance...

-

Q1) The equity of Washington Ltd at 1 July 2020 consisted of: Share capital 500 000 A ordinary shares fully paid $1 500 000 400 000 B ordinary shares issued for $2 and paid to $1.50 600 000 General...

-

out The following information relates to Questions 1 to 2. The management accountant of a furniture manufacturer is developing a standard for the labour cost of one massage chair. When operating at...

-

Exercise 10-8 Utilization of a constrained Resource [LO10-5, L010-6] Barlow Company manufactures three products: A, B, and C. The selling price, variable costs, and contribution margin for one unit...

Study smarter with the SolutionInn App