From the following data, calculate the Retained Earnings balance as of December 31, 2022: Retained earnings, December

Question:

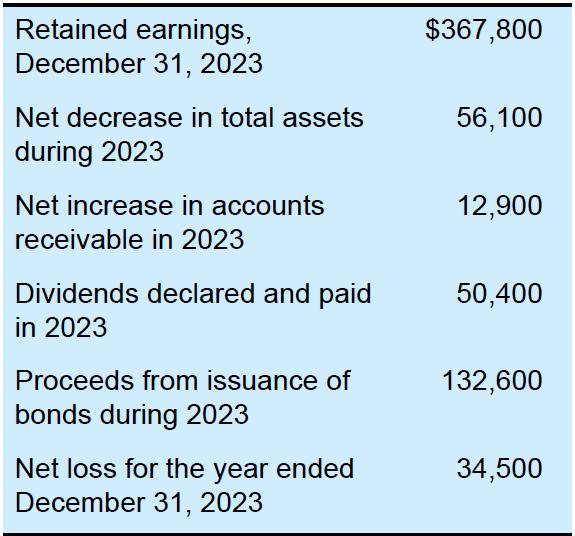

From the following data, calculate the Retained Earnings balance as of December 31, 2022:

Transcribed Image Text:

Retained earnings, December 31, 2023 Net decrease in total assets during 2023 Net increase in accounts receivable in 2023 Dividends declared and paid in 2023 Proceeds from issuance of bonds during 2023 Net loss for the year ended December 31, 2023 $367,800 56,100 12,900 50,400 132,600 34,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Prepare the retained earnings portion of a statement of changes in st...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

From the following data, calculate the Retained Earnings balance as of December 31, 2011: Retained earnings, December 31, 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

From the following data, calculate the Retained Earnings balance as of December 31, 2017: Retained earnings. December 31, 2016...................................... $692,800 Cost of building...

-

From the following data, calculate the Retained Earnings balance as of December 31, 2010: Retained earnings, December 31, 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Convert decimal + 49 and + 29 to binary, using the signed-2's-complement representation and enough digits to accommodate the numbers. Then perform the binary equivalent of ( +29) + (-49), (-29) +...

-

Far Horizons, Inc. sells mobile phones, wireless plans, and service plan packages. Far Horizons packages the following items for sale. Far Horizons has determined that each item is a separate...

-

In a storage location of 4 bits, a sign-and-magnitude integer could be any integer from 0 to 15, inclusive. True or False

-

The prism shown in Figure P24.31 has an index of refraction n = 1.75 for a particular color of light. Four different incident rays are shown in the figure. Construct a ray diagram showing the...

-

You are an audit supervisor assigned to a new client, Go-Go Corporation, which is listed on the New York Stock Exchange. You visited Go-Gos corporate headquarters to become acquainted with key...

-

Lease versus Buy Sadik Industries must install $ 1 million of new machinery in its Texas plant. It can obtain a 6 - year bank loan for 1 0 0 % of the cost at a 1 4 % interest rate with equal payments...

-

How should companies that use temp workers supplied by temp agencies deal with those workers if performance problems emerge? If temp workers complain about inequitable treatment? If temp workers...

-

The balance sheet caption for common stock is the following: Required: a. Calculate the dollar amount that will be presented opposite this caption. b. Calculate the total amount of a cash dividend of...

-

From the following data, calculate the Retained Earnings balance as of December 31, 2023: Retained earnings, December 31, 2022 $346,400

-

Which of the following control procedures is not usually performed in the vouchers payable department? (a) Determining the mathematical accuracy of the vendor's invoice. (b) Having an authorized...

-

Leslie Sporting Goods is a locally owned store that specializes in printing team jerseys. The majority of its business comes from orders for various local teams and organizations. While Leslie's...

-

Euclid acquires a 7-year class asset on May 9, 2022, for $153,000 (the only asset acquired during the year). Euclid does not elect immediate expensing under 179. He does not claim any available...

-

Williams & Sons last year reported sales of $10 million, cost of goods sold (COGS) of $8 million, and an inventory turnover ratio of 2. The company is now adopting a new inventory system. If the new...

-

A ceramic manufacturer promised to deliver 25 crates of vases to a Japanese importer under a "CFR" INTERCOM agreement. During transit, however, a large number of vases were broken. The buyer wants to...

-

A company receives $364, of which $23 is for sales tax. The journal entry to record the sale would include a ?

-

A hair dryer can be used to create a stream of air. Is the air pressure in the center of the stream greater than, less than, or equal to the air pressure at some distance from the center of the...

-

You deposit $10,000 in a savings account that earns 7.5% simple interest per year. What is the minimum number of years you must wait to double your balance? Suppose instead that you deposit the...

-

SAS is a world leader in business analytics software, delivering breakthrough technology to transform the wav- organizations do business. At sas.com many activity-based management (Cost and...

-

Production and purchases budgets Osage, Inc., has actual sales for May and June and forecast sales for July, August, September, and October as follows: Required: a. The firm's policy is to have...

-

Trail Center's sales are all made on account. The firm's collection experience has been that 30% of a month's sales are collected in the month the sale is made. 50% are collected in the month...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App